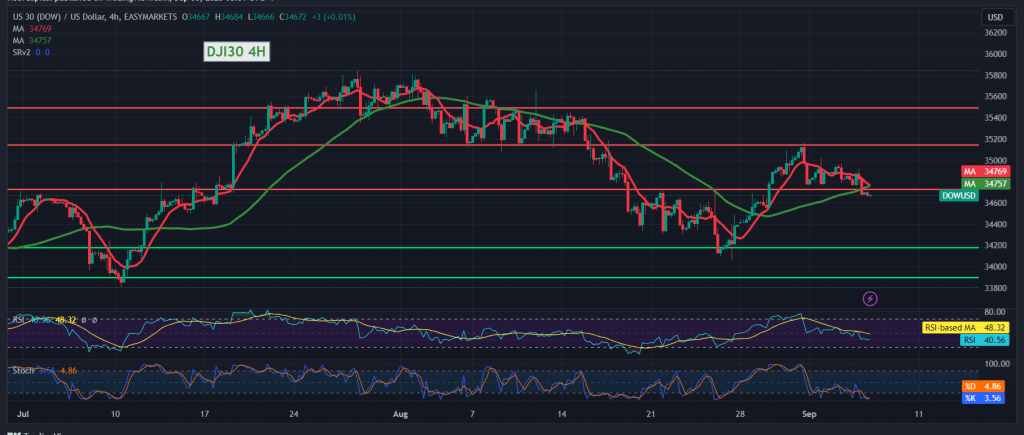

Dow Jones on the Wall Street Stock Exchange yesterday towards the first bearish target during the previous technical report for the realistic index at a recorded price of 34,720, the lowest and its price of 34,660.

Technically, we prefer the daily bearish trend based on the stability below the 34,840 resistance level, the clear negativity on the Relative Strength Index and its stability below the 50 midline.

Therefore, we maintain our expectation of loss, toward the second target of the report, 34,620 and then 34,580, taking into account the violation of use below 34,580, a clear pressure factor in the details of the path towards 34,490.

We remind you that exceeding upwards and rising above 34,845 invalidates the activation of the proposed option and it recovers specifically to retest 35,000 initially.

Note: Today we are awaiting statistics on economic data with a high impact on the American economy, “the ISM Services Purchasing Managers Index,” and we may witness a high price fluctuation before the news is released.

Note: Risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations