The Dow Jones Industrial Average declined significantly on Wall Street yesterday, recording large losses, reaching its lowest level of 33006.

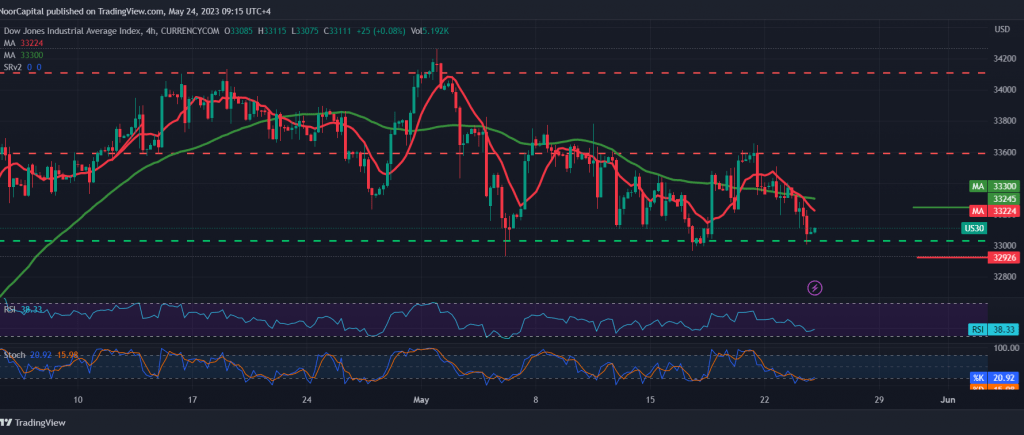

Technically, with a closer look at the 4-hour chart, the negative pressure emanating from the Simple Moving Averages is still valid, stimulated by the clear negative signs on the RSI over the short time frames.

In our trading, we tend to be negative, with the stability of daily trading below the resistance level of 33250, targeting 33000 as the first target, knowing that breaking it increases and accelerates the strength of the bearish daily trend, paving the way for the index to visit 32945 and 32900, respectively.

Closing an hourly candlestick above the resistance above the level located at 33,250 may invalidate the activation of the suggested scenario, and the index tries to recover temporarily to visit 33,340.

Note: Today we are awaiting highly sensitive economic data issued by the US economy, “the results of the Federal Reserve Committee meeting,” the speech of the US Treasury Secretary, and we are awaiting “inflation” data from the United Kingdom and the talk of the “Governor of the Bank of England,” in addition to the report issued by the International Energy Agency regarding Oil stocks, and we may witness high volatility in prices at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations