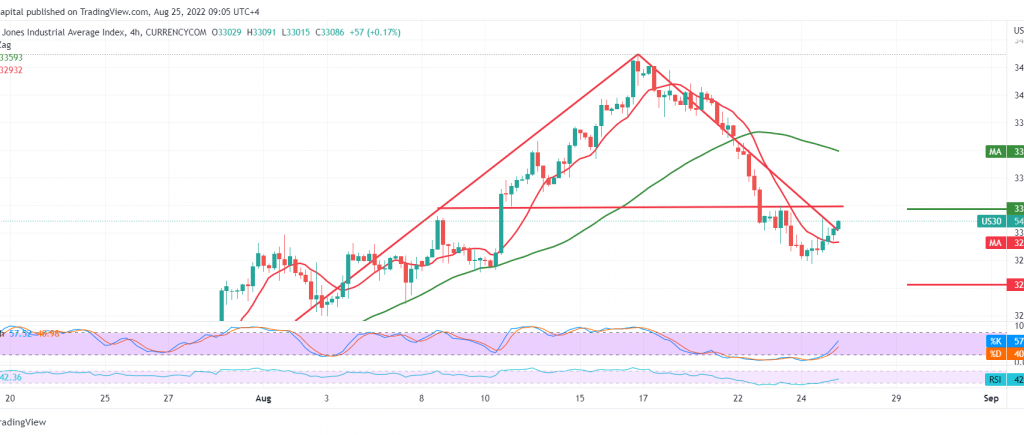

The Dow Jones Industrial Average witnessed a bearish trend during yesterday’s session, recording its lowest level at 32,750 as part of the buying rejection.

Technically, there are current attempts to recover. However, they are still limited. With a closer look at the 60-minute chart, we find the simple moving averages continuing the negative pressure and the index’s pivot point below the 33,170 resistance level.

Therefore, the bearish trend may be the most preferred, and we await confirmation of breaking 32,990; this facilitates the task required to visit the first target at 32,840, and then 32,630.

Skipping the upside and ascending again above 33,170 can thwart the bearish scenario suggested above and lead the issuer to form an ascending corrective attack with its initial target of 33,290.

Note: The Jackson Hole Economic Forum is taking place today, it has a significant impact on the markets, and we may see random moves.

Note: The preliminary reading of the US quarterly GDP is due, and price volatility may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations