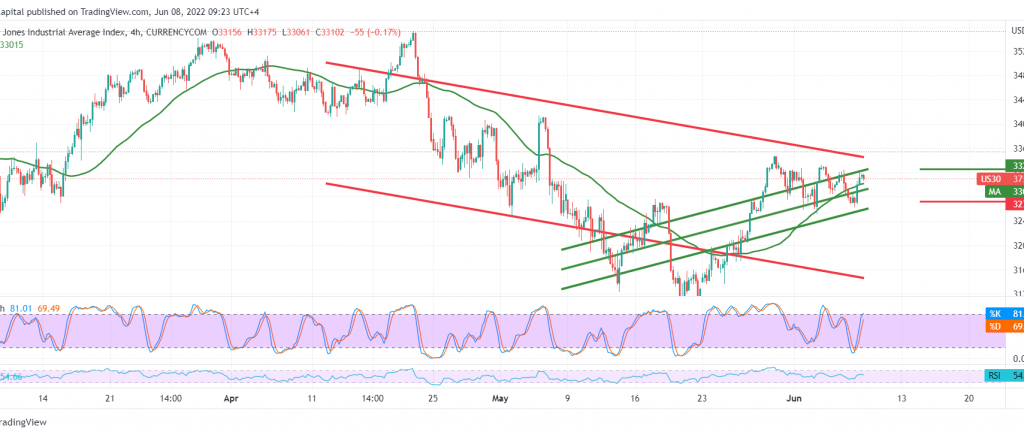

Mixed trading dominated the movement of the Dow Jones Industrial Average on Wall Street after it received good support near the 32,600 level, which forced it to rebound upwards.

Technically, the current movements of the indicator are witnessing a bullish slope, building on the pivot at the support level of 32,900, accompanied by the attempts of the 14-day momentum indicator to obtain positive signals; on the other side, there is a negative crossover signal that started to appear on the stochastic.

With the conflicting technical signals, we prefer to monitor the price behaviour of the indicator so that we are waiting for the following:

Confirmation of the decline needs to break 32,900 to target 32,730, while consolidation and stability above 33,100 are motivating factors that reinforce the index’s gains, so we will be waiting for 33,320.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations