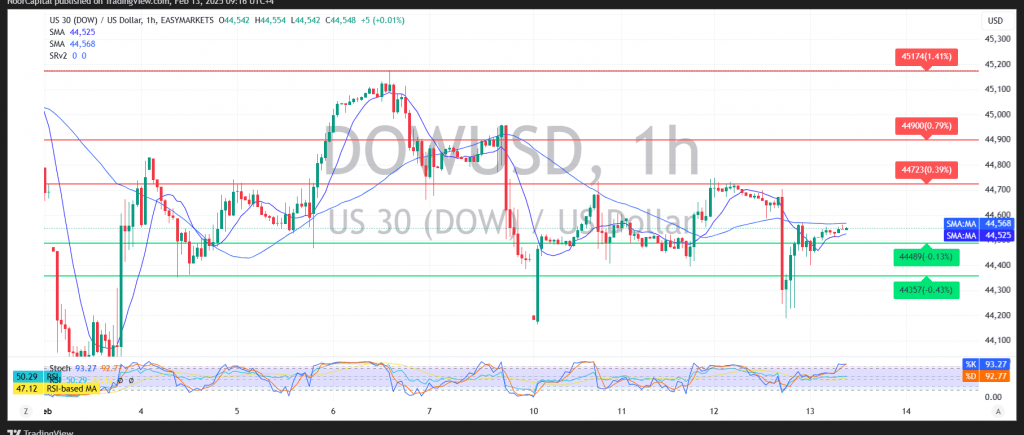

Dow Jones Industrial Average (DJIA) Technical Analysis

The Dow Jones Industrial Average (DJIA) showed positive attempts in the previous session, reaching a high of 44,700 on the New York Stock Exchange.

Technical Outlook:

- Bullish Factors:

- Simple moving averages continue to provide upward momentum.

- Relative Strength Index (RSI) signals positive strength in the short term.

- Key Levels to Watch:

- Bullish Scenario:

- Holding above 44,390 and a clear breach of 44,560 may drive the index toward 44,770.

- Bearish Scenario:

- A confirmed break below 44,390 may trigger downward pressure, targeting 44,260.

- Bullish Scenario:

Market Risks & Considerations:

- High-impact US economic data (Producer Price Index, Weekly Unemployment Claims) may cause significant volatility.

- Ongoing trade tensions contribute to elevated risks and market uncertainty.

⚠ Risk Warning: The risk level remains high, and all scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations