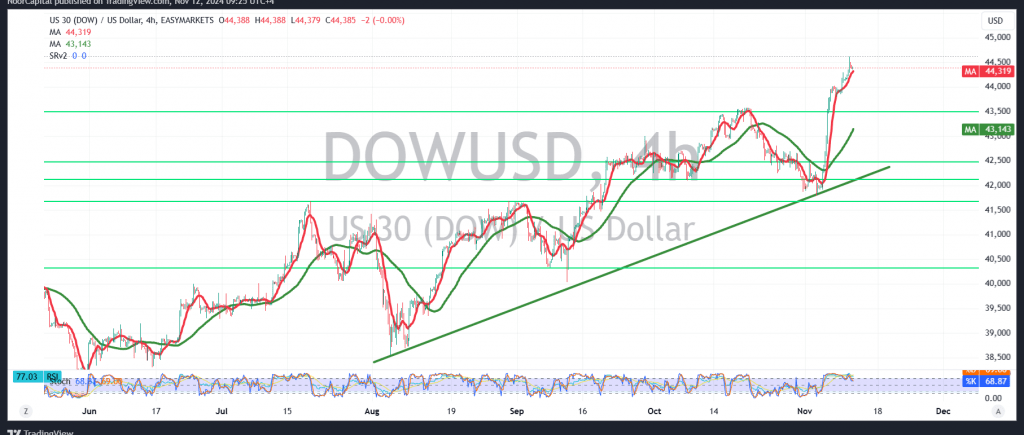

The Dow Jones Industrial Average surged significantly, aligning with the previous positive forecast, reaching the target of 44,560 and extending to a peak of 44,625.

Technical Analysis:

- Upward Momentum: The index remains supported by positive signals, particularly from the 14-day momentum indicator on shorter time frames. This suggests a favorable outlook for continued gains.

- Support & Resistance: As long as trading stays above the key support level of 44,260, the upward trend remains likely. The next target is 44,615, and surpassing this level could accelerate gains toward 44,850.

- Downside Risk: If the index falls below 44,260, this could delay upward momentum, with potential support levels at 44,160 and 44,090, before possibly resuming an uptrend.

Warnings:

- High Risk: Given the current geopolitical climate, the risk is elevated, which could result in sudden and unpredictable market movements. Caution is advised when making investment decisions.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations