Positive trading dominated the movements of the Dow Jones Industrial Average on Wall Street, recording its highest level of 34,254.

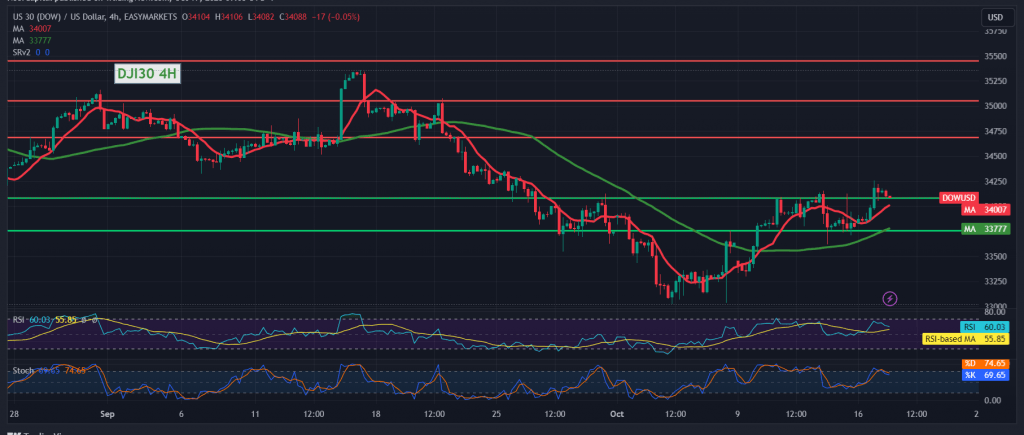

On the technical side today, with a closer look at the 4-hour chart, we find the 50-day simple moving average still trying to push the price higher, in addition to positive signals from the Relative Strength Index on the 60-minute time frame.

From here, with daily trading remaining above 33,865, there may be an upward trend, provided that we witness the price consolidation above 34,150, which is a motivating factor that enhances the chances of a rise to visit 34,295.

Below 33,865 leads the index to negative pressure, with targets starting at 33,630.

Note: Today, we are awaiting high-impact economic data in the US, retail sales index and the annual core consumer price index from Canada, and we may witness high volatility at the time of the news release.

The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations