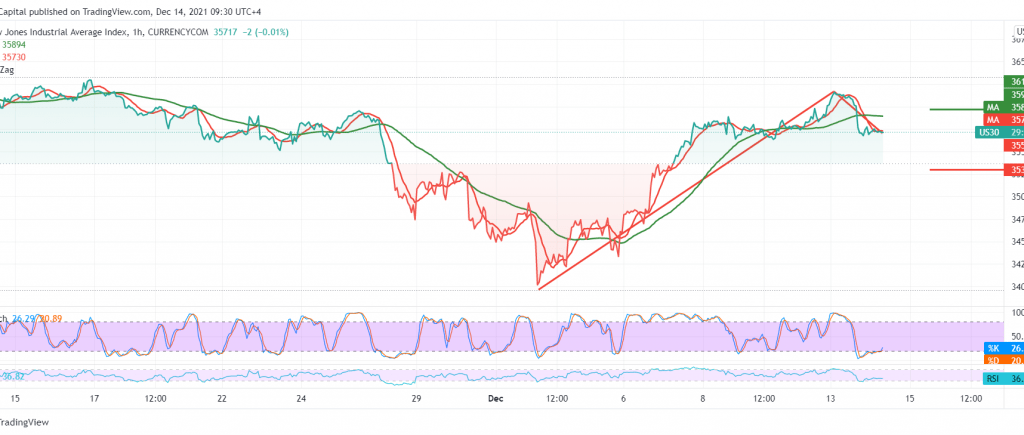

The Dow Jones Industrial Index touched the first official target required to be achieved during the previous analysis, at 36,065. It is approaching the next stop at 36,160, to record its highest level of 36,100.

Technically and carefully looking at the 60-minute chart, we notice the beginning of negative signals from the momentum indicator. This comes in conjunction with the clear negative signs on the RSI.

With intraday trading remaining below the resistance level 35,760, and most importantly 35,850, the bearish bias is likely today, but very cautiously, targeting 35,480 first target, knowing that breaking the target level puts the index price under strong negative pressure, targeting 35,290.

If stability returns and ascends again above 35,850 will postpone the chances of a decline, but it does not cancel them, and we may witness a bullish slope, whose target is 35,980, before retracing.

Note: The risk level is high.

| S1: 35480 | R1: 35980 |

| S2: 35290 | R2: 36290 |

| S3: 34980 | R3: 36480 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations