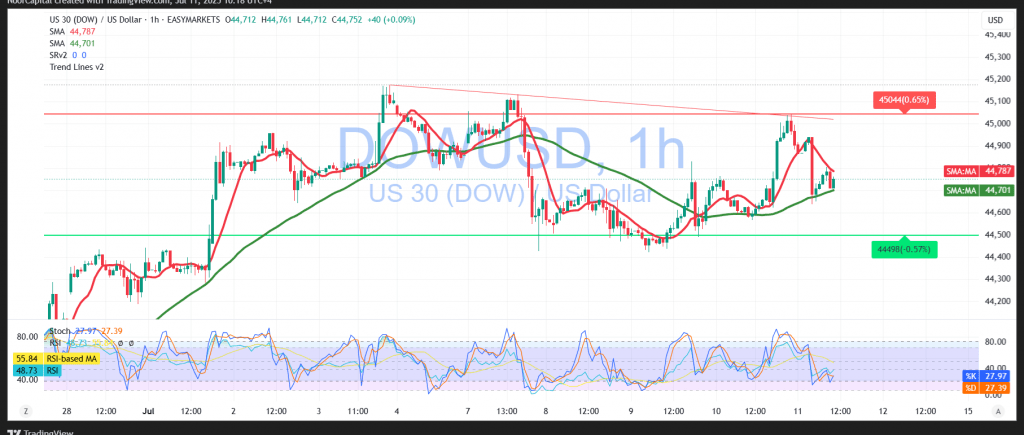

The Dow Jones Industrial Average continues its attempts to gain ground on Wall Street, approaching key resistance levels near 45,045.

Technical Outlook for Today’s Session:

The index is currently exhibiting a mild bearish bias, constrained by the psychological resistance at 45,000, along with a bearish crossover of the simple moving averages, which are now acting as dynamic resistance. Additionally, the Relative Strength Index (RSI) shows a slowdown in upward momentum, increasing the likelihood of a short-term pullback—though this would not necessarily invalidate the broader upward trend.

Probable Scenario (Bearish Correction within Bullish Context):

In the near term, the index may face a decline toward the 44,670 support level. A break below this level could deepen the correction, with the next support area seen around 44,530.

Alternative Scenario (Bullish Continuation):

If the index manages to reclaim and hold above the 45,000 level, this would reinforce the dominant bullish trend. In that case, we could see further upside moves targeting 45,260, followed by 45,480.

Caution:

The risk environment remains elevated due to persistent trade and geopolitical tensions. As always, traders should prepare for increased volatility and manage risk appropriately.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations