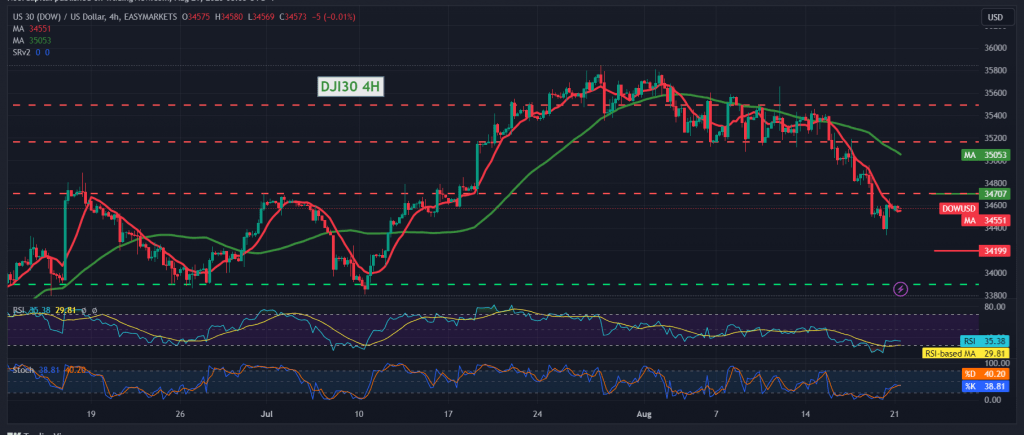

Negative trading dominated the movements of the Dow Jones Industrial Average on Wall Street within the expected bearish context, surpassing the first target achieved during the previous report at 34,380, recording its lowest level at 34,330.

On the technical side, the index returned to achieve some bullish rebound due to approaching the target represented by support. Upon closer look at the 240-minute chart, we find that the simple moving averages continue to pressure the price from above, in addition to the clear negative signs on the stochastic.

From here, with the stability of trading below 34,700, that encourages us to maintain our negative expectations, targeting 34,380 as a first target, knowing that breaking the mentioned level increases and accelerates the strength of the bearish trend, paving the way for the index to visit 34,200.

Only from above, skipping upwards above 34,710/34,700 will immediately stop the suggested scenario and lead the index to recover, heading towards 34,850.

Note: the risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations