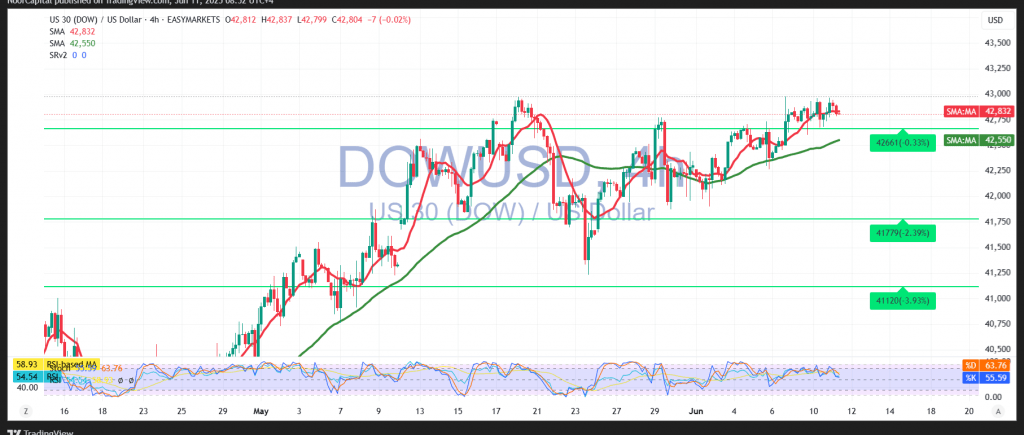

The Dow Jones Industrial Average extended its bullish momentum, reaching a new high of 42,967 during the previous trading session, reinforcing the prevailing upward trajectory.

On the technical side, the simple moving average continues to offer solid support from below, sustaining the broader bullish structure. However, early signs of bearish divergence are beginning to emerge on the Relative Strength Index (RSI), suggesting the potential for a temporary pullback or consolidation.

In the short term, we lean toward a cautious bearish bias, which is corrective in nature and does not contradict the prevailing daily uptrend. A confirmed break below 42,770 could facilitate a move toward the 42,660 support level, where price may attempt to regain bullish momentum.

Conversely, a return to stable trading above 42,900, and more decisively above 42,950, would invalidate the corrective scenario and open the door for a continuation of the bullish trend. In this case, upside targets align at 43,110, with further potential to test 43,280 in the sessions ahead.

Market Risk Warning:

Today’s release of U.S. Core Consumer Price Index (CPI) data—both monthly and annual—is expected to be a significant market mover. Traders should prepare for elevated volatility across U.S. equity indices as the data may directly influence expectations surrounding Federal Reserve policy direction.

Caution: With global trade tensions and broader macro risks still elevated, all scenarios remain on the table. Employ disciplined risk management during news-driven sessions.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations