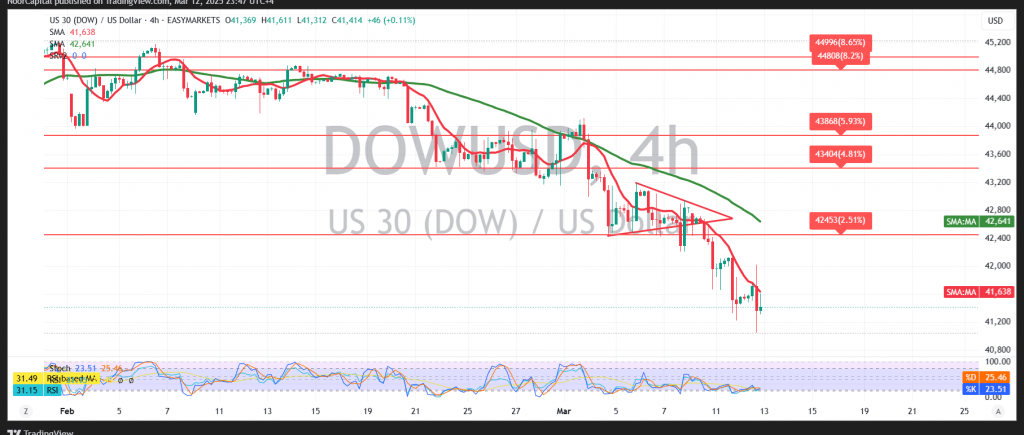

The Dow Jones Industrial Average maintained its expected downward trend, reaching the third target at 41,220 and recording a low of 41,046 in the previous session.

Our outlook remains bearish, supported by:

- The negative crossover of the simple moving averages, exerting downward pressure on the index.

- The stochastic indicator settling in oversold areas, reinforcing bearish momentum.

As long as trading remains below the 41,975 resistance level, the downtrend is likely to continue. A confirmed break below 41,045 is essential for further declines, with targets at 41,000, potentially extending to 40,540.

On the upside, a break above 41,975 with an hourly candle close could shift momentum, prompting a retest of 42,480.

Market Watch & Risk Factors

Risk remains high amid ongoing market uncertainty, making **all scenarios possible

Highly impactful U.S. economic data (monthly and annual producer price index reports and weekly jobless claims) are expected today, potentially causing high volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations