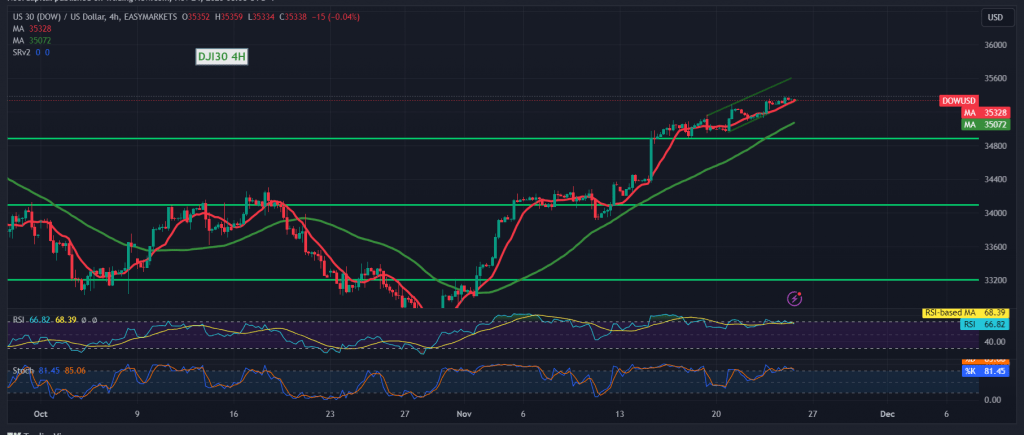

The Dow Jones Industrial Average displayed notable gains within the anticipated bullish trajectory as outlined in the latest technical report, reaching the designated target at a price of 35380 and achieving its highest level at 35390.

Upon examining the 4-hour chart, the ongoing support from simple moving averages sustains the upward momentum, complemented by positive signals from the 14-day momentum indicator.

Consequently, the prevailing expectation is an upward trend throughout the day, particularly with the consolidation of prices above 35390. This not only enhances but expedites the strength of the upward trend, with the first target set at 35440. Subsequent gains may extend towards 34540.

On the downside, a return to stable trading below the robust support at 35190 would invalidate the proposed bullish scenario, leading to a negative trading session aimed at retesting the previously breached resistance, now converted into support at 35030.

Warning: Today’s market activity may be impacted by high-impact economic data from the Eurozone, the press talk by the President of the European Central Bank, and updates from the American economy. The release of the “preliminary reading of the services and manufacturing purchasing managers’ index” may induce high price fluctuations.

Warning: The overall risk level is elevated due to ongoing geopolitical tensions, potentially resulting in heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations