Mixed Trading Continues for Dow Jones Industrial Average

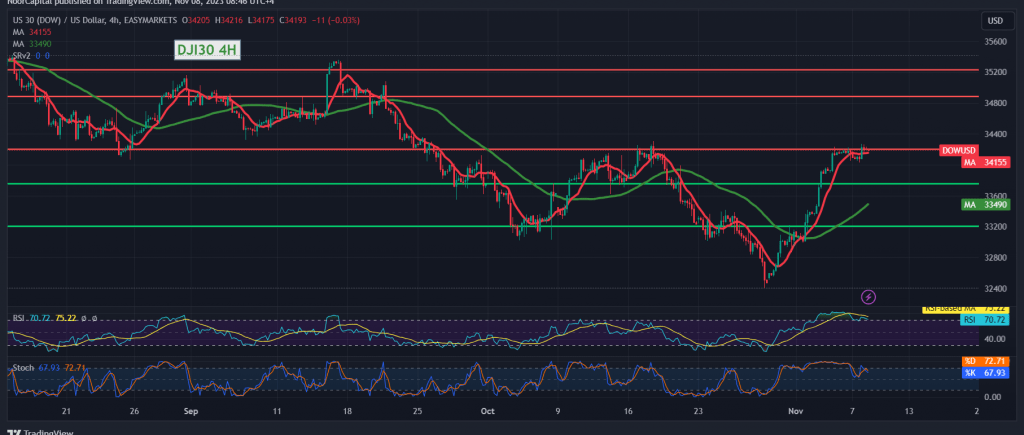

The Dow Jones Industrial Average experienced mixed trading within a bearish trend, coming close to the anticipated target of 34010 and reaching a low of 34030.

From a technical perspective, current intraday movements are indicating stability below the critical resistance level of 34230. Additionally, the Stochastic indicator on the 4-hour time frame is showing a gradual loss of bullish momentum.

In the upcoming hours, a bearish bias may prevail if the index price consolidates below 34150. This could pave the way for a visit to 34060 as the initial target, and further losses might extend towards 33940.

On the upside, a breakout above 34230 and subsequent consolidation could invalidate the temporary bearish scenario, leading the index to recover and target levels at 34295 and 34410.

Please exercise caution as we await significant press talks today, featuring “Federal Reserve Governor Jerome Powell” and “BoE Governor.” These events may result in high price fluctuations.

Be aware that the current market environment carries a high level of risk due to ongoing geopolitical tensions, potentially leading to increased price volatility. Stay vigilant and make informed trading decisions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations