The Dow Jones Industrial Average jumped in New York during the previous trading session after the US inflation data, recording its highest level of 34972.

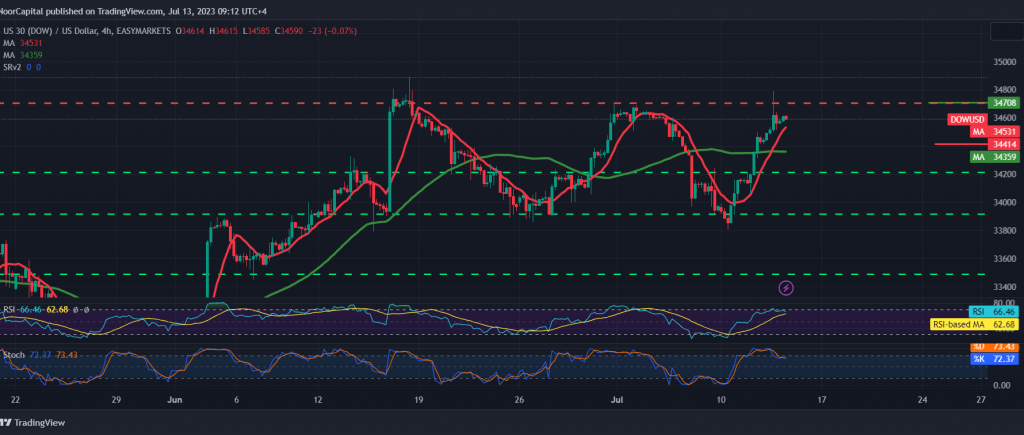

On the technical side today, and by looking at the 4-hour chart, we notice the continuation of moving above the simple moving averages, and the RSI continues to defend the bullish direction.

From here, with trading steadily above the support level of 34,420, the bullish bias is more likely during the day, provided that we witness the price’s breach and consolidation of the resistance level of 34,710, targeting 34,770 as the first target and its breach reinforces the index’s gains, opening the door towards 34,960 and 35,000, respectively.

Only from below, closing the hourly candlestick below 34,420 nullifies the activation of the suggested scenario and puts the index under negative pressure, with an initial target of 34,260.

Note: Today we are waiting for high-impact economic data issued by the US economy, “US inflation data, producer price index” from England, and we are waiting for “Gross Domestic Product”, and we may witness high volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations