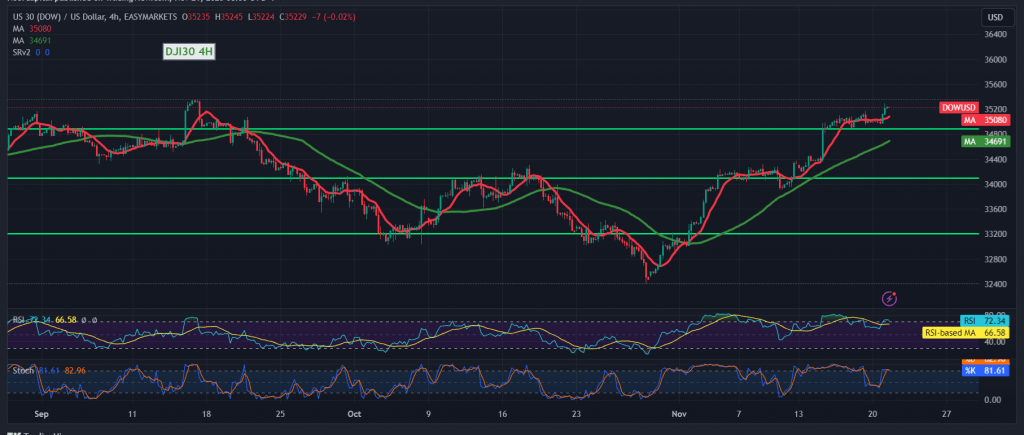

Large gains characterized the movements of the Dow Jones Industrial Average on Wall Street at the beginning of this week’s trading, aligning with a positive outlook as anticipated. The index touched the official target of 35260, recording its highest level at 35293.

From a technical perspective today, a positive stance is favored, contingent upon the indicator confirming the breach of the 35030 resistance level, now acting as a support level. This is complemented by the continued defense of the upward trend by the Relative Strength Index, along with positive motivation from the 50-day simple moving average.

Consequently, the most likely scenario for the day is an upward trend, contingent upon a clear breach of the 35290 resistance level. This would serve as a motivating factor, increasing the likelihood of a rise towards 35360 as the first target, with potential gains extending further towards 35490.

On the downside, a break below 35030 would delay upward attempts and exert negative pressure on the index, targeting a retest of 34830.

A word of caution: Today, high-impact economic data is expected from the American economy, specifically the results of the Federal Reserve Committee meeting and the press talk of the President of the European Central Bank. Additionally, the release of the consumer price index from Canada may lead to increased price volatility. The overall risk level is elevated due to continuing geopolitical tensions. Investors should exercise caution and remain alert to market developments.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations