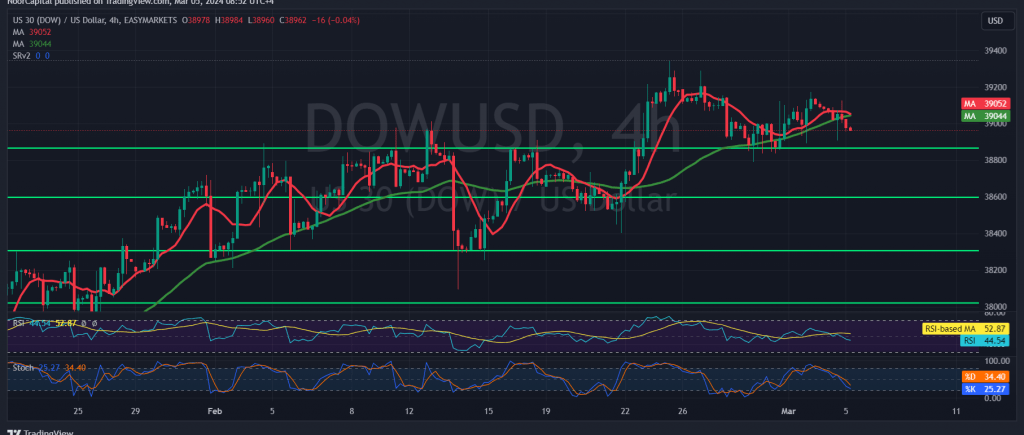

Negative sentiment dominated the movements of the Dow Jones Industrial Average on the New York Stock Exchange during the initial trading sessions last week, with the index currently hovering around 38,960.

From a technical perspective today, we are inclined towards a negative outlook, albeit with caution. This is based on the temporary stabilization of trading below the 50-day simple moving average, which is exerting downward pressure on the price. Additionally, negative signals from the Relative Strength Index further support this sentiment.

As a result, we may observe a bearish trend in the coming hours, with the initial target set at 38,870. It’s important to closely monitor the price behavior at this level. However, it’s worth noting that a consolidation above 39,090 would negate the temporary bearish bias and signal a resumption of the uptrend, with targets at 39,125 and 39,215.

Investors should exercise caution, especially considering the high-impact economic data expected from the American economy today, particularly the Services Purchasing Managers’ Index issued by the ISM. This release may contribute to increased volatility in the market.

In summary, while a negative bias is currently observed, traders should remain vigilant and adapt their strategies accordingly, considering both technical indicators and external factors such as geopolitical tensions and economic data releases.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations