The Dow Jones Industrial Average posted sharp losses during the previous U.S. trading session, falling to a session low of 41,306.

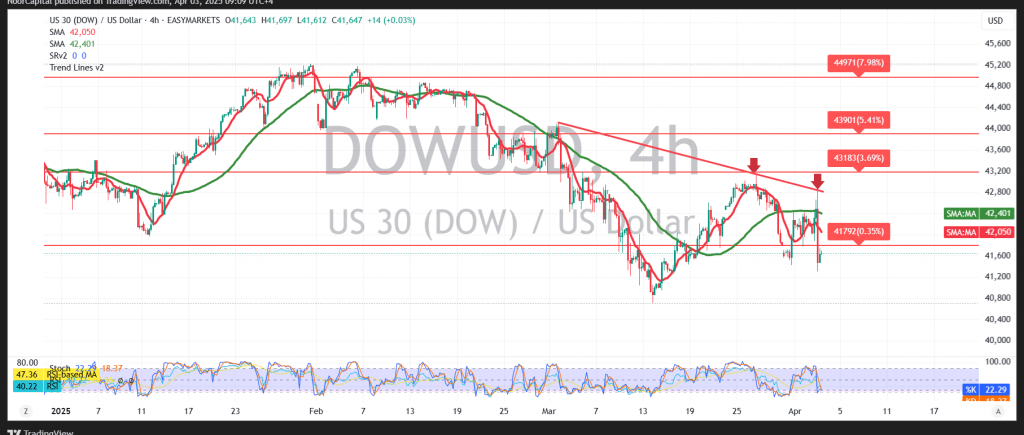

From a technical perspective, we are observing mixed signals. The index is trading below key simple moving averages, suggesting sustained bearish momentum. However, the 14-day momentum indicator is attempting to generate short-term positive signals, adding to the uncertainty and increasing the likelihood of volatile price action.

A confirmed move below the 41,440 support level could accelerate the decline toward the next target at 41,020. On the upside, a break above the 42,050 resistance level would signal a potential recovery, with the next resistance seen at 42,400.

More immediately, a one-hour candle close above 42,045 may act as an early trigger for bullish momentum, paving the way for a potential retest of the 42,440 level.

Caution: Today’s economic calendar includes key U.S. data releases—namely Weekly Unemployment Claims and the ISM Services PMI—which could spark heightened volatility across equity markets.

Risk Disclaimer: With ongoing trade tensions and broader market uncertainties, the risk environment remains elevated. Traders should remain cautious and prepared for a wide range of market scenarios.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations