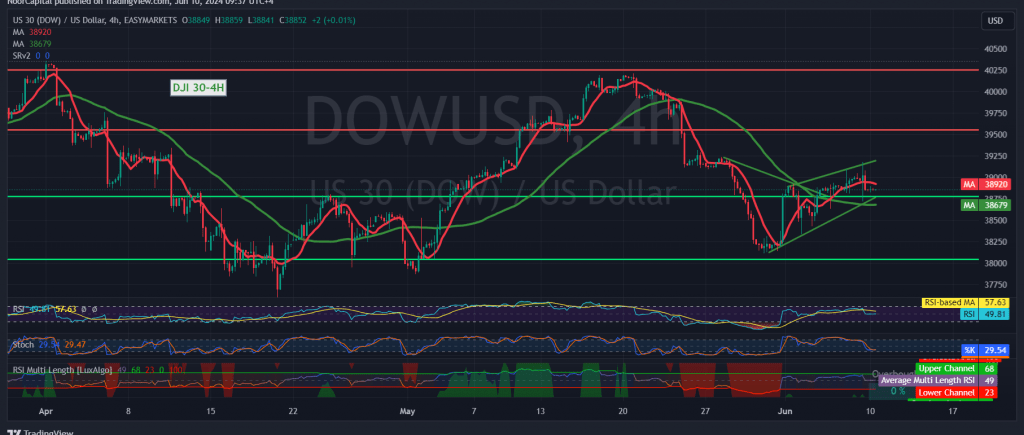

The Dow Jones Industrial Average experienced mixed trading at the end of last week, attempting to hold above the 38720 support level. Today’s technical analysis reveals a delicate balance between bullish and bearish signals, creating a critical juncture for the index.

On the short-term timeframes, the simple moving averages are lending support to the upward movement, suggesting continued buying interest. Additionally, the index remains above the 37770 support level. However, the Stochastic oscillator is showing signs of weakening upward momentum, raising concerns about a potential reversal.

The Dow Jones’s immediate future hinges on its ability to maintain its position above 38790. A break below this level could trigger a sharp decline, with the potential to retest the 38650 support. Conversely, a decisive move above 39110 could ignite a bullish rally, targeting 39370.

Investors should exercise caution as the market faces heightened risks. Geopolitical tensions continue to create uncertainty, and the potential for high price fluctuations remains elevated. Additionally, unforeseen events could easily disrupt the current market dynamics.

In conclusion, the Dow Jones is at a crucial crossroads, with both bullish and bearish scenarios possible. The next few trading sessions will be critical in determining the direction of the index. Investors should closely monitor the price action around key support and resistance levels and remain prepared for potential volatility due to the prevailing geopolitical risks.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations