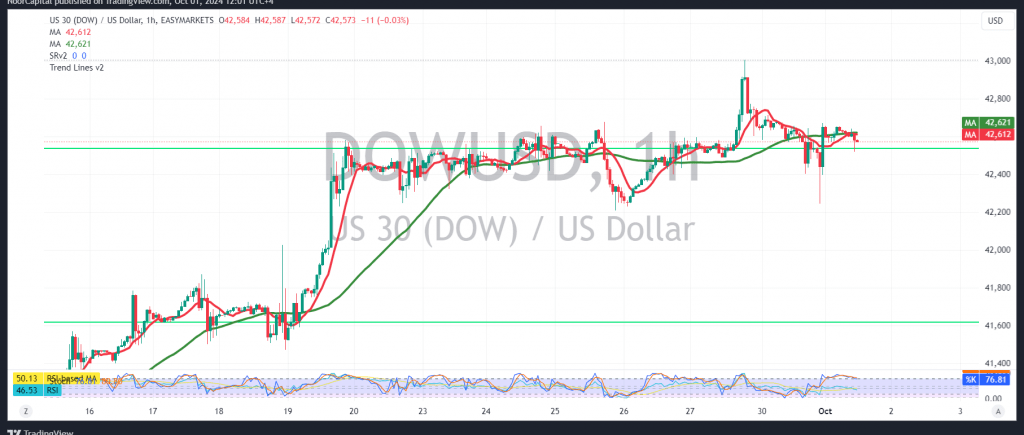

The Dow Jones Industrial Average experienced mixed trading during the first session of the week, reaching a peak of 42,680 on the New York Stock Exchange.

From a technical standpoint, our outlook remains cautiously positive, supported by the continued positive signals from the Relative Strength Index and the 50-day simple moving average, which offers an encouraging incentive.

There is potential for the upward trend to persist, especially if we see a clear breach of the 42,595 level, which could pave the way towards 42,760, with gains potentially extending to 42,940.

However, if trading stabilizes below 42,320, the index may face temporary downward pressure, targeting 42,070 initially.

Warning: The level of risk may be high and may not align with the expected return.

Alert: Today, we anticipate high-impact economic data from the US, specifically the “Job Vacancies and Labor Turnover Rate,” which could trigger significant price fluctuations.

Warning: The risk level remains elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations