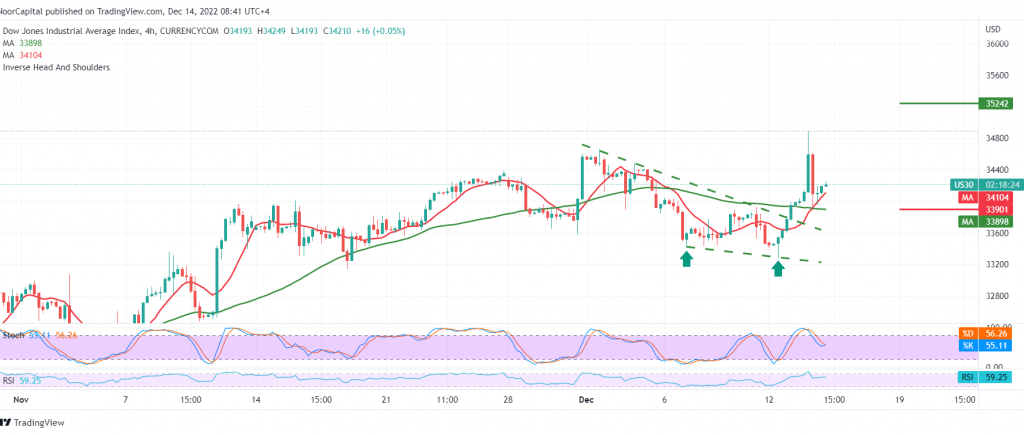

Strong gains were achieved by the Dow Jones Industrial Average on Wall Street after the US inflation data, taking advantage of the US currency’s decline, bypassing the official targets targeted during the previous technical report at 34,225, recording its highest level at 34,895.

On the technical side, we find the Dow Jones index retreated very quickly after touching the aforementioned top at 34,895, to return to test the 50-day simple moving average, and it is still stable above. We find the relative strength index defending the continuation of the bullish daily trend.

Therefore, with the index maintaining trading above the support level of 33,895, the bullish scenario remains the most likely, targeting 33,775 first, and then 34,895, knowing that the breach of the latter increases and accelerates the strength of the rise, reaching 35,240.

Note: Today we are awaiting high-impact economic data from the United States of America, and we may witness high volatility:

Fed interest rates

Fed statement

Fed press conference

Economic forecasts

Note: Trading on CFDs involves risks and therefore scenarios may be possible. What was explained above is not a recommendation to buy or sell, but rather an illustrative reading of the price movement on the chart.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations