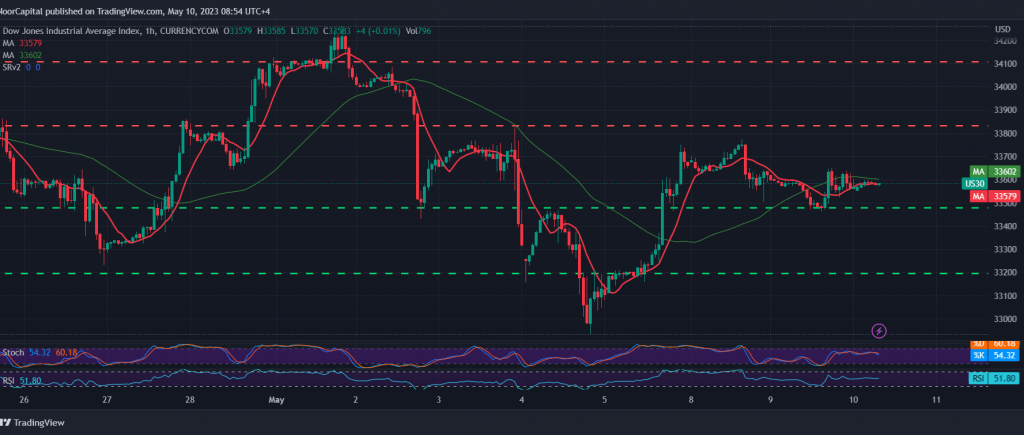

The Dow Jones Industrial Average fell on Wall Street yesterday, invalidating the positive outlook we expected, in which we relied on the index’s stability above 33,510, recording its lowest level at 33,462.

Technically, we find the Stochastic indicator trying to get rid of the current negativity, and this comes in conjunction with the RSI attempts to obtain positive signs on the hourly time frame.

We tend to be positive, but with caution, with the stability of intraday trading above 33,470, targeting 335,70 as a first target, knowing that the price’s consolidation above the target level paves the way to visit 33,670 initially.

We remind you that the decline below 33,470 invalidates the activation of the suggested scenario, and the Dow Jones Index witnesses negative pressure, targeting 33,370, and the losses may extend later towards 33,290.

Note: Today, we are awaiting high-impact economic data issued by the US economy, “US inflation data, consumer price index,” and we may witness high price fluctuations at the time of the news release.

Note: The level of risk is high and may not be commensurate with the expected return, and all scenarios are open to occurrence.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations