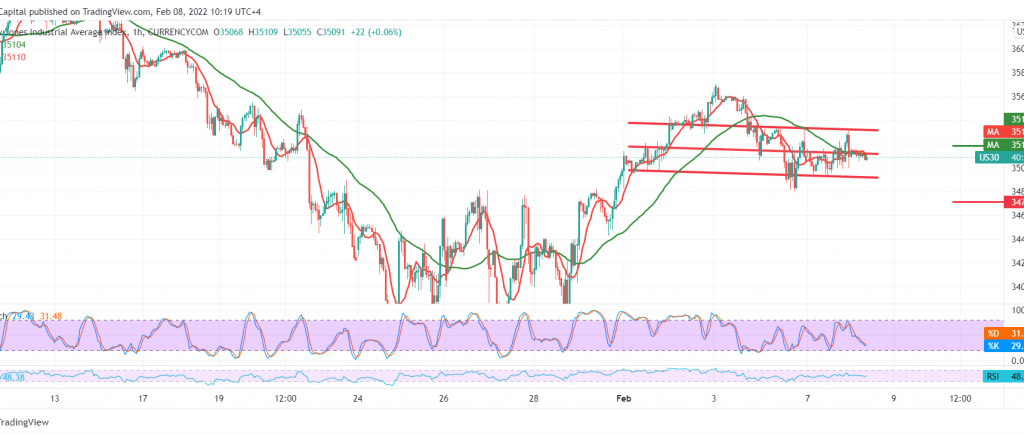

The Dow Jones Industrial Average declined significantly during the previous trading session, nullifying the expected bullish tendency in the last analysis, and settled below 35,175.

On the technical side today, and by looking at the 60-minute chart, we notice the clear negative signs on the RSI and its stability below the 50 mid-line, in addition to the stochastic gaining more bearish momentum.

A decline below the 34,930 level may facilitate the task required to visit 34,790, and it may extend later to reach 34,700 as long as the price is stable below 35,175.

Consolidation again above 35,175 leads the index to recover from around 35,380.

Note: The risk level is high.

Note: CFD trading involves high risk; all scenarios may occur.

| S1: 34790 | R1: 35175 |

| S2: 34610 | R2: 35380 |

| S3: 34405 | R3: 35560 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations