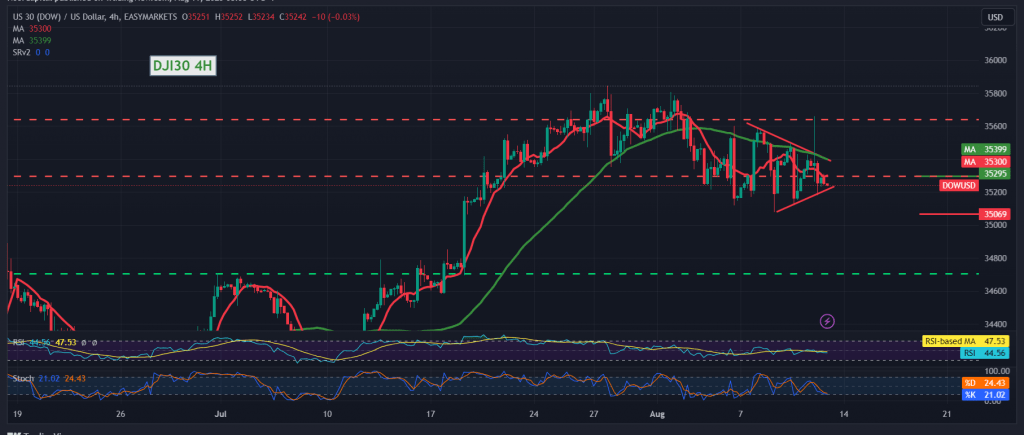

We adhered to intraday neutrality during the previous technical report due to the existence of a contradiction between the technical signals, explaining that the price’s consolidation above 35,515 is a catalyst that increases the possibility of touching 35,690, for the index to record its highest level at 35,660.

On the technical side today, we tend to be negative in our trading, but with caution, relying on the negative pressure from the 50-day simple moving average, which comes in conjunction with the negative signals from the relative strength index.

With the stability of intraday trading below 35,300, the bearish scenario is the most likely during today’s trading, targeting 35,160 as the first target and then 35,060 as the next official station.

As a reminder, the price’s consolidation above 35,300 may postpone chances of a downside move, and the index’s movements witness a bullish bias, aiming to retest 35540.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations