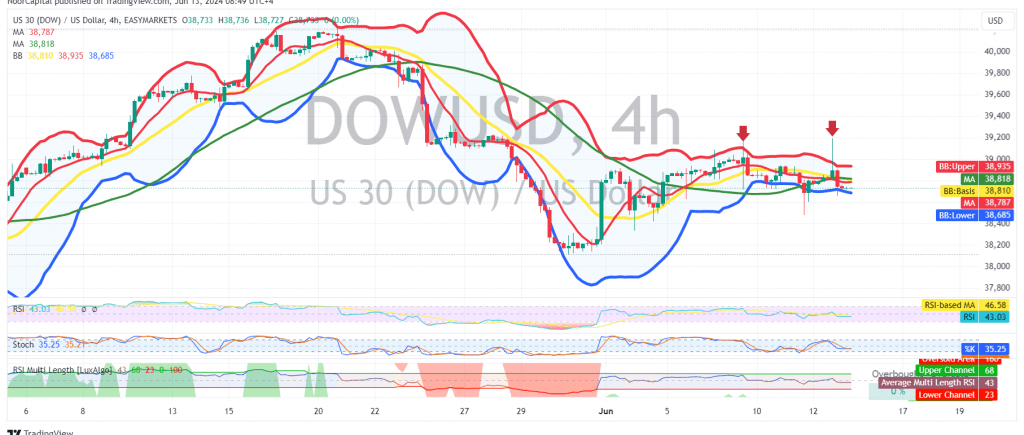

The Dow Jones Industrial Average closed lower yesterday, failing to hold above the 39000 level and reaching a low of 38660.

Technical Indicators

The simple moving averages have formed a negative crossover, exerting downward pressure on the price. Additionally, the 14-day Momentum indicator is showing clear negative signals on short time intervals, reinforcing the bearish sentiment.

Outlook and Trading Strategy

We lean towards a negative outlook, but with caution, as long as the index remains below the 38810 resistance level. Our initial downside target is 38685. A break below this level could extend losses towards 38530.

However, traders should be mindful of the possibility of a reversal. A close above 38810 would postpone the decline and potentially lead to a retest of 39000 and 39065.

Important Note

The release of high-impact U.S. economic data today, including annual producer prices and basic monthly/annual producer prices excluding energy and food, could induce significant price volatility. Traders should exercise caution and closely monitor market reactions to these data releases.

Key Levels

- Resistance: 38810, 39000, 39065

- Support: 38685, 38530

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high, and potential returns may not be proportional to the risks involved.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations