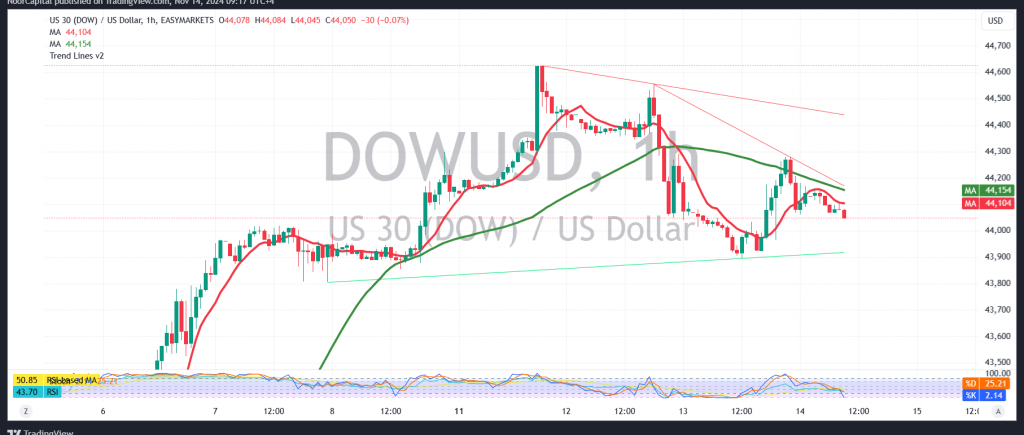

The Dow Jones Industrial Average experienced significant profit-taking during the last session, continuing within a downward path and coming close to the desired target of 43,850, hitting a low of 43,897.

From a technical perspective, a cautious bearish outlook is maintained. This is supported by the stability of current trading below the previously broken support level, which now serves as resistance at 44,260 and most critically at 44,600. Additional bearish pressure comes from negative signals on the Relative Strength Index over short time frames.

As a result, a bearish trend may continue in the near term, with 43,870 as the first target. If this level breaks, it could lead to further declines, targeting 43,695.

Conversely, if there is a crossover to the upside and the price stabilizes above 44,260, the bearish scenario could be fully invalidated, and the Dow Jones may recover, potentially aiming for 44,465.

Warning: The risk level remains high, possibly disproportionate to the expected return, and should be approached with caution.

Alert: The release of significant US economic data, such as the “Consumer Price Index – Annual and Consumer Price Index – Monthly,” may trigger substantial price volatility.

Geopolitical Risk Warning: The environment is highly volatile, and ongoing geopolitical tensions may lead to unpredictable market outcomes.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations