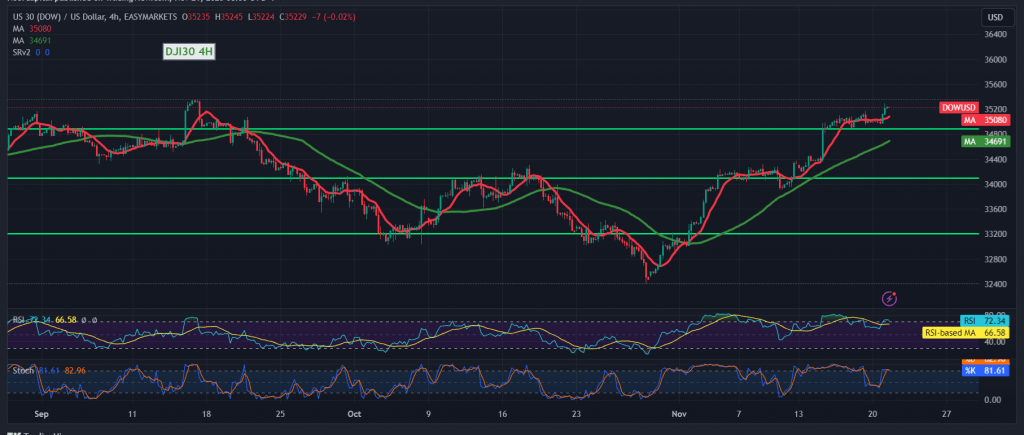

In the previous trading session, the Dow Jones Industrial Average on the Wall Street Stock Exchange exhibited an upward trend within the expected bullish context, reaching its highest level at 35240.

From a technical perspective today, the outlook leans towards positivity, relying on the confirmation of the indicator breaking through the 35090 resistance level, which has now become a support level. This is supported by the Relative Strength Index’s defense of the upward trend, in conjunction with the positive motivation of the 50-day simple moving average.

As such, the most likely scenario for the day is an upward trend, contingent on a clear breach of the 35240 resistance level. This would serve as a motivating factor, enhancing the chances of a rise towards 35310 as the first target. Gains may extend further towards 35380.

On the downside, if the index slips below 35090, it would delay attempts to rise and introduce negative pressure, leading to a retest of 35020 and 34950.

A cautionary note: High-impact economic data from the American economy is anticipated today, including the revised reading of the Consumer Confidence Index from the University of Michigan and a press talk by the Governor of the Bank of Canada. This could result in increased price fluctuation.

Risk Warning: The level of risk is high amid continuing geopolitical tensions, and high price volatility may be witnessed.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations