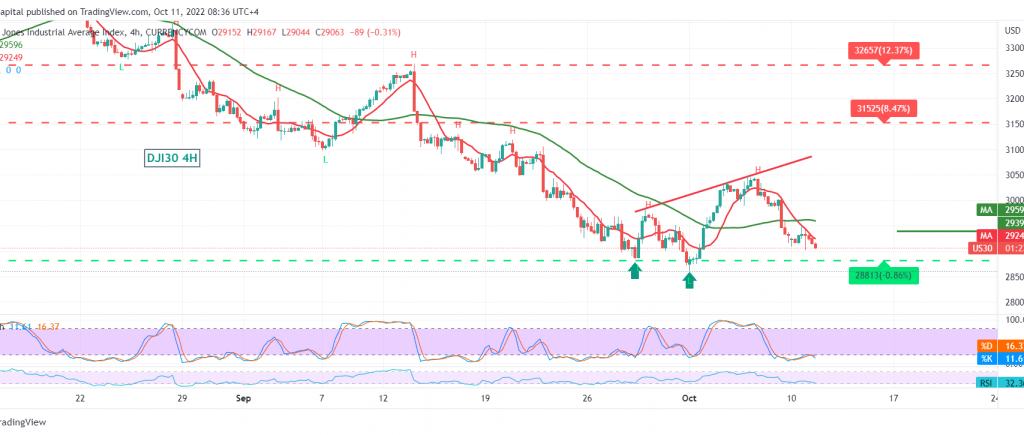

A bad mood dominates the US market due to several factors affecting the markets, most notably the central banks’ approach to raising interest rates to combat inflation, in addition to the Russian-Ukrainian conflict, so that the Dow Jones Industrial Average failed to maintain the bottom that it had previously tried to set above 30,000.

Technically and by looking at the 60-minute chart, we find that the RSI continues to defend the bearish trend and that Stochastic is showing a noticeable loss of momentum.

Stability of trading below 29,390, the resumption of the decline is the most likely, knowing that the decline below 29,000 increases and accelerates the strength of the daily bearish trend, opening the door towards the 28,910 first target. Losses may extend later to visit the next 28,740 waiting station unless we witness the return of daily stability above 29,390, as It may lead the index to recover temporarily towards 29,710.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations