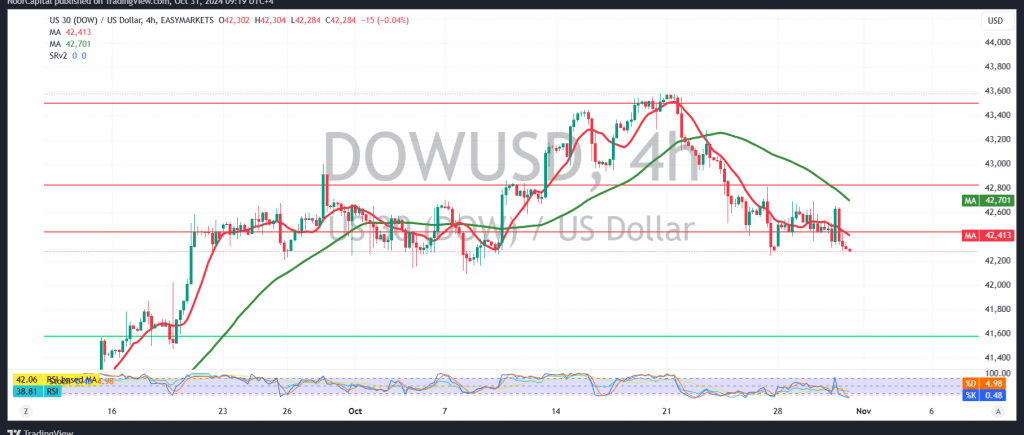

The Dow Jones Industrial Average saw a significant decline in the previous session, bottoming out at 42,287 and stabilizing around that level.

Technical Analysis:

- Downward Trend: The outlook remains bearish due to continued pressure from simple moving averages and additional negative signals from the 14-day momentum indicator.

- Target Levels: Stability below the 42,470 resistance level supports a downward trend, with 42,160 as the first target. Breaking below this level could extend losses, opening the path to the 42,040 support zone.

- Upside Scenario: A return above 42,470 would reduce the immediate bearish pressure, with 42,520 as a possible recovery target in the short term.

Warnings:

- High-impact U.S. economic data (Core PCE Prices, Unemployment Benefits, Employment Cost Index) could cause significant price volatility.

- High-risk conditions prevail amid geopolitical tensions, suggesting that unexpected scenarios could develop.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations