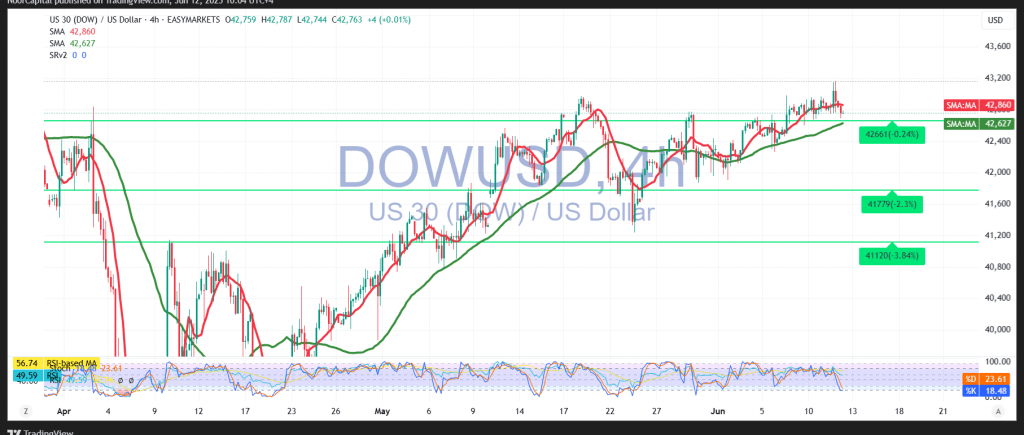

The Dow Jones Industrial Average followed the anticipated negative trajectory from the previous report, reaching the targeted support zone near 42,660 and recording a session low of 42,688 during U.S. trading hours.

Technically, the simple moving average is still acting as dynamic support, helping to cushion the decline from below. However, early signs of bearish momentum are starting to emerge on the Relative Strength Index (RSI), indicating the potential for continued downward pressure in the near term.

Given this setup, the outlook remains cautiously bearish. A confirmed break below 42,650 would reinforce the downside scenario, clearing the path toward the first target at 42,590. If momentum builds, losses could extend further to test support at 42,400.

Reminder: A sustained recovery and daily close above 43,060 would invalidate the bearish setup and revive the bullish outlook, paving the way for potential advances toward 43,160 and 43,350.

Warning: Market conditions remain highly sensitive ahead of today’s release of the U.S. monthly and annual Core Producer Price Index (PPI), which may trigger heightened volatility across equity markets.

Warning: Risk remains elevated amid persistent trade tensions, and multiple scenarios are possible. Proceed with caution.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations