The Dow Jones Industrial Average experienced a modest upward trend on Wall Street yesterday, reaching a high of around 42,430.

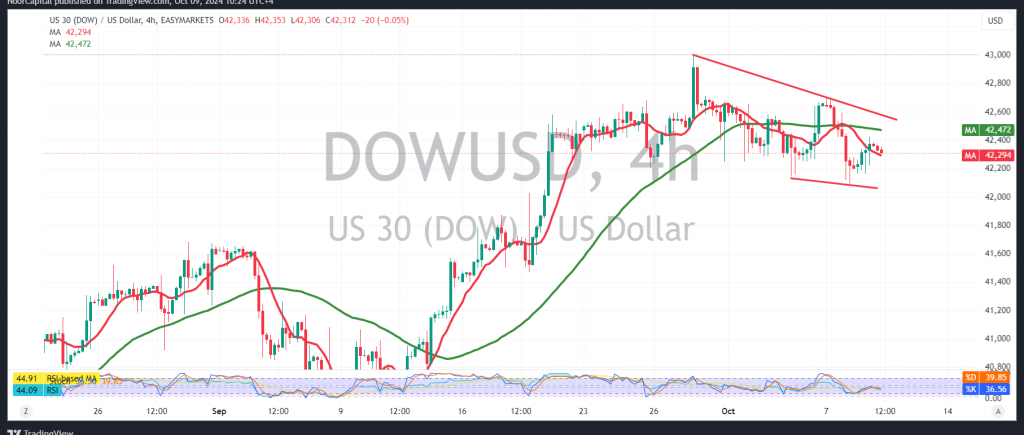

Technically, today’s outlook leans toward a cautious bearish stance, supported by downward pressure from the moving averages and a 14-day momentum indicator remaining below the 50 midline. Additionally, the Stochastic indicator is showing negative signals, reinforcing the possibility of a decline.

Given these factors, the index could target 42,170 initially, and breaking below this level would likely trigger further downward pressure toward 42,030.

On the other hand, if the index stabilizes above 42,440, it could invalidate the bearish outlook, with a potential recovery leading to targets around 42,570.

Warning: The risk level is high and may not align with the expected return.

Alert: High-impact economic data, including the “Federal Reserve Committee meeting results,” is expected today, and we may see heightened volatility during the news release.

Risk Alert: Elevated risk persists due to ongoing geopolitical tensions, making various scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations