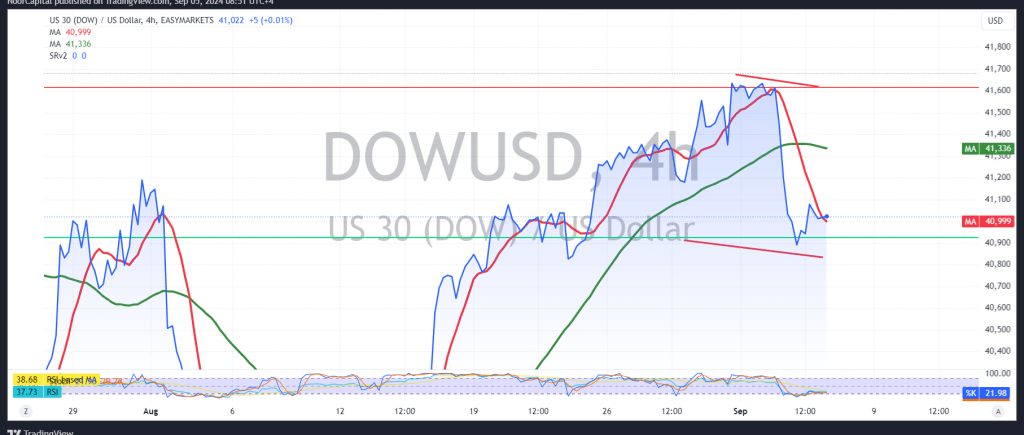

The Dow Jones Industrial Average experienced selling pressure in the previous session, aligning with the negative outlook outlined in the prior technical report. The index reached the first target at 40,930, hitting a low of 40,853.

Technical Analysis:

Today, we lean toward a cautious bearish outlook, supported by negative pressure from the 50-day simple moving average and clear bearish signals on the 14-day momentum indicator.

Therefore, as long as intraday trading remains below the resistance level of 41,230, and most importantly 41,270, there is a possibility of a continued downward trend, targeting 40,825 as the initial station, with potential extension towards 40,640.

However, should trading stabilize above 41,270, the index may recover and resume its upward trend, with targets starting at 41,450.

Warning: The risk level is high and may not align with the expected return.

Warning: Today, we expect high-impact U.S. economic data, including non-farm private sector jobs, weekly unemployment claims, and the ISM Services PMI, which may trigger significant price volatility.

Warning: Geopolitical tensions are ongoing, increasing the likelihood of high volatility in the markets.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations