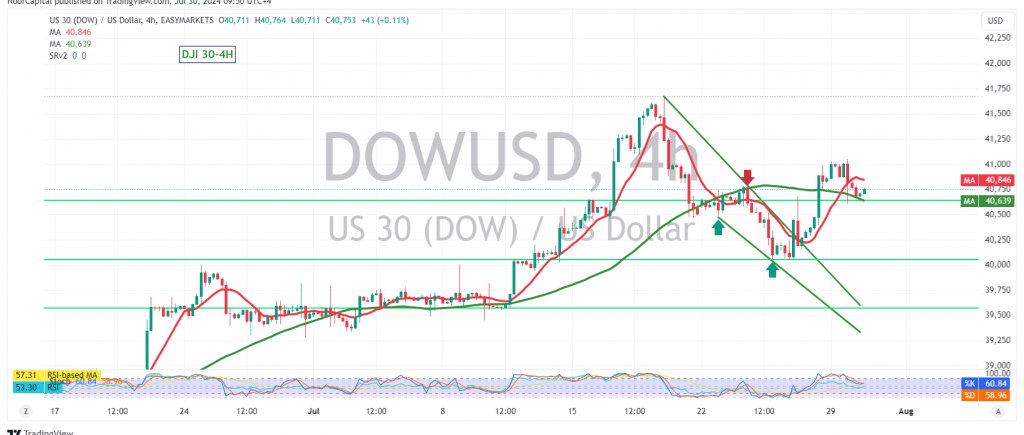

The Dow Jones Industrial Average exhibited a bearish trend on the New York Stock Exchange yesterday, reaching a low of 40,607.

From a technical perspective, the bearish trend is likely to persist due to ongoing negative pressure from the simple moving averages, which act as resistance. This is further supported by clear negative signals from the 14-day momentum indicator on shorter time frames.

A clear and strong break below the 40,610 level could signal the continuation of the downward trend, with an initial target of 40,560. If this level is breached, the decline may accelerate, paving the way for a move towards 40,360.

However, if the index manages to stabilize above the strong resistance level at 41,005, this would invalidate the bearish scenario and could lead to a temporary recovery. In such a case, a retest of 41,250 and 41,450 would be anticipated.

Caution: The risk level may be high and may not align with the expected return.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations