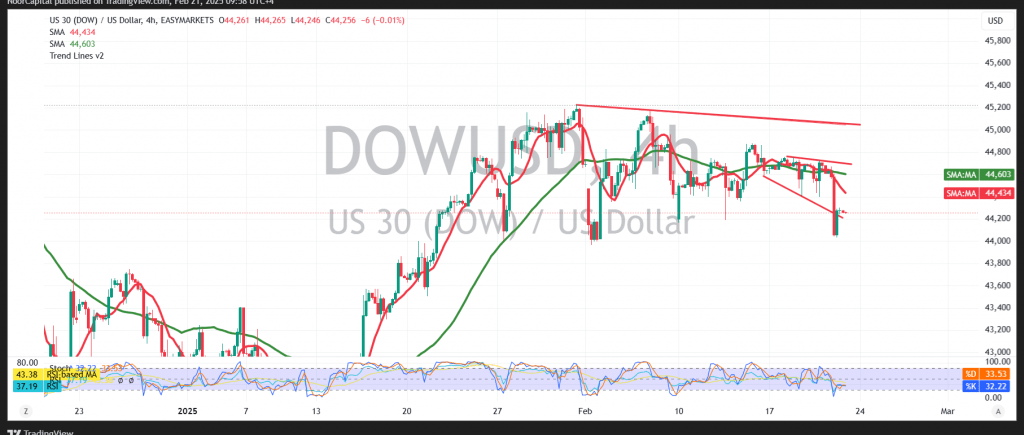

The Dow Jones Industrial Average experienced a sharp decline in the New York Stock Exchange during the previous session after encountering strong resistance near 44,670, leading to bearish movements.

Technical Analysis

- The Relative Strength Index (RSI) is signaling negative momentum on short-term intervals.

- The simple moving averages (SMA) are applying downward pressure, reinforcing the potential for further declines.

- As long as the index remains below 44,350, the likelihood of further bearish movement increases.

Key Levels to Watch

- Bearish Scenario: A continued drop toward 43,970 is expected, with further downside potential if selling pressure persists.

- Bullish Scenario: If the index stabilizes above 44,350, an upside move towards 44,550 may take place.

Market Outlook and Risk Warning

With ongoing trade tensions and market uncertainties, the risk level remains high, and traders should be prepared for all possible scenarios.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations