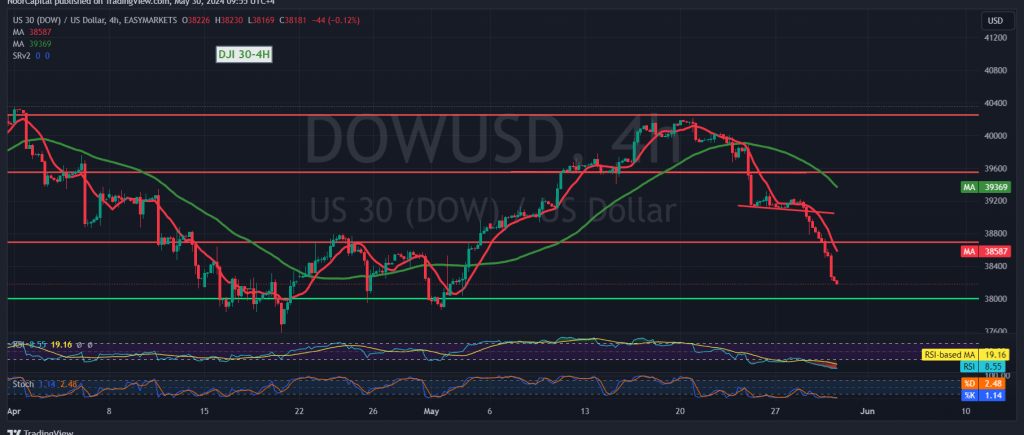

The Dow Jones Industrial Average experienced a significant decline, as anticipated, reaching the targeted level of 38510 and even dipping further to a low of 38170. This bearish momentum is likely to persist, as technical indicators continue to point towards further downside potential.

The simple moving averages remain a key resistance barrier for the index, while the Relative Strength Index (RSI) on shorter timeframes continues to exhibit negative signals, reinforcing the bearish outlook.

As long as intraday trading stays below the 38620 resistance level, the downward trend is expected to continue. A break below the 37950 support level could trigger a deeper decline, with potential targets at 37725.

However, a decisive move above 38620, with at least an hourly candle close above this level, could invalidate the bearish scenario. This would likely lead to a retest of the 39065 level before the market determines its next direction.

Traders should exercise caution as high-impact economic data releases from the U.S. economy, including unemployment benefits and the preliminary reading of quarterly GDP, are scheduled for today. These announcements could cause significant price fluctuations.

Furthermore, ongoing geopolitical tensions continue to elevate the risk of market volatility. Investors are advised to closely monitor these developments and adjust their strategies accordingly to navigate the potential risks.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations