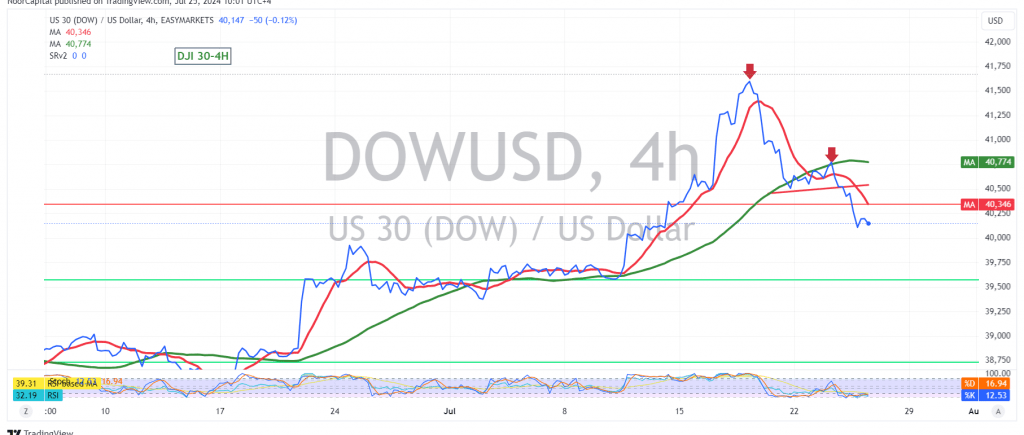

The Dow Jones Industrial Average experienced significant losses on the New York Stock Exchange, continuing the expected downward trend from the previous session. The index surpassed the target of 40210, reaching a low of 40054.

From a technical perspective, the downward trend remains the most likely scenario, supported by ongoing negative pressure from the simple moving averages, which act as resistance, along with clear negative signals on the 14-day momentum indicator over short time intervals.

The expectation is for the downward trend to continue, especially if there is a clear and strong break below the 40055 level, targeting 39970 as the first stop. A break below this level could further accelerate the decline, opening the path towards 39780.

However, a return to trading stability above the strong resistance at 40450 would invalidate this bearish scenario and could lead to a temporary recovery, with the index potentially retesting 40720.

Warning: The level of risk is high and may not be proportional to the expected return.

Warning: Today’s trading session may experience significant price volatility due to high-impact economic data releases from the American economy, including the preliminary GDP reading (quarterly) and weekly unemployment benefits.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations