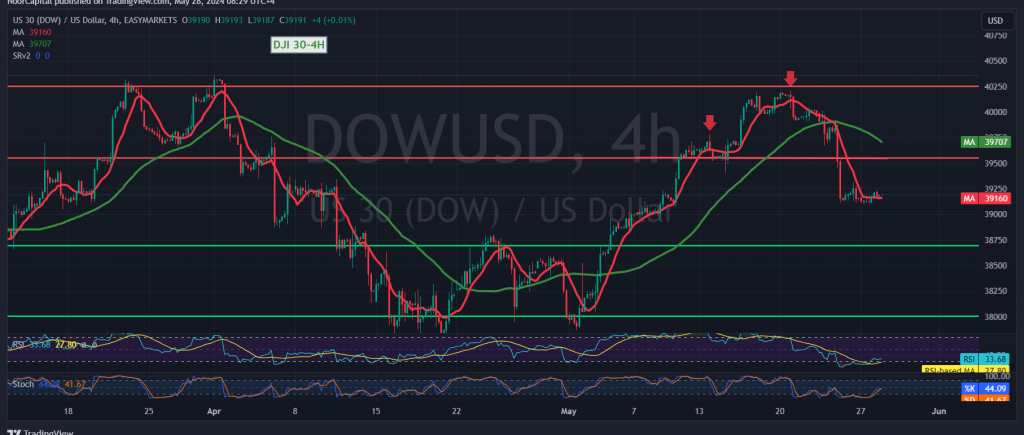

The Dow Jones Industrial Average experienced a significant decline on Wall Street, hitting a low of 39,095. Technical indicators suggest the potential for further downside movement.

Technical Analysis Indicates Downward Bias

The simple moving averages are currently acting as resistance for the index, supporting the bearish outlook. Additionally, the 14-day momentum indicator on short time intervals is flashing clear negative signals.

Downside Targets and Support Levels

As long as intraday trading stays below the 39,262 resistance level, the downward trend could continue, with an initial target of 39,110. A break below this level could intensify the decline, potentially leading to further targets of 39,035 and 38,970.

Upside Risks and Resistance Levels

However, an hourly candle closing above 39,260 could delay the potential decline and lead to a retest of 39,550 before the next price direction is determined.

Cautionary Notes:

- US Economic Data: The release of the US Consumer Confidence Index later today may trigger significant price volatility.

- High Risk Environment: The current market environment is characterized by elevated risks, potentially outweighing the expected returns.

- Geopolitical Tensions: Ongoing geopolitical uncertainties could also lead to sharp price fluctuations.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations