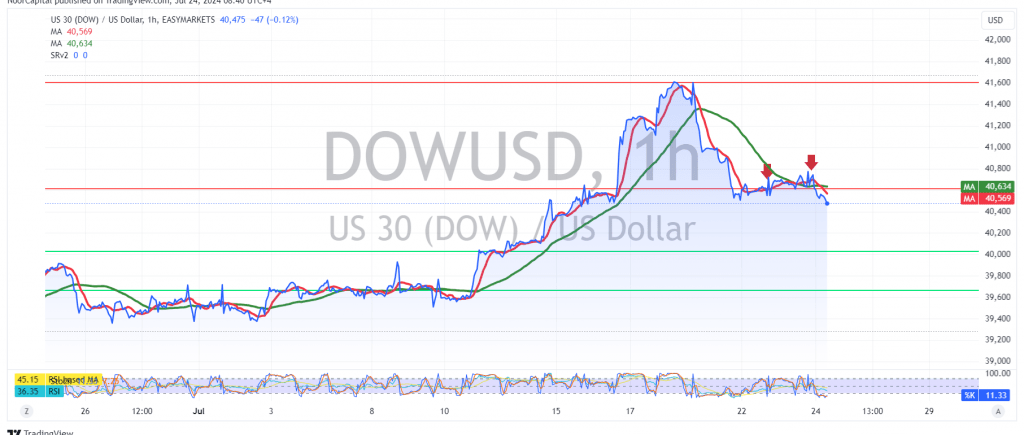

The Dow Jones Industrial Average on Wall Street achieved its first downward target during the American trading period of the previous session, reaching a low of 40434, just below the anticipated target of 40520.

Today, the technical outlook remains cautiously bearish. This perspective is supported by ongoing negative pressure from the 50-day simple moving average and the Relative Strength Index (RSI), which continues to signal a downward trend.

If the index experiences a clear and strong break below the 40430 level, this could lead to a further decline, with 40340 as the initial target. A breach of this level may accelerate the downward movement, potentially opening the path towards 40210.

Conversely, a return to stability above the strong resistance at 40630, and more crucially above 40700, would invalidate the bearish scenario. In such a case, the index could see a temporary recovery, with a retest of 40930 expected.

Warning: Today, we anticipate high-impact economic data releases, including the preliminary readings of the services and manufacturing PMI indices from the Eurozone, the United Kingdom, and the United States, as well as the Canadian interest rate decision and the Bank of Canada’s press conference. These events may lead to significant price volatility.

Warning: The risk level remains high amid ongoing geopolitical tensions, which could result in substantial price fluctuations.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations