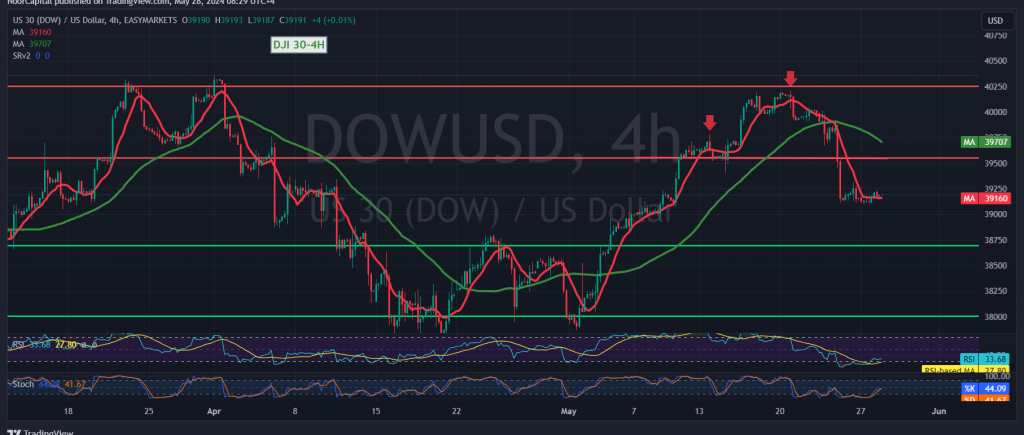

Dow Jones Faces Further Downward Pressure, Technical Indicators Suggest

The Dow Jones Industrial Average successfully reached its projected bearish target of 38970, briefly dipping to a low of 38787 in the previous trading session. Technical indicators suggest that the downward momentum may persist, with the potential for further declines.

Currently, the simple moving averages are acting as a resistance barrier for the index, reinforcing the bearish outlook. Additionally, the 14-day momentum indicator on shorter timeframes is flashing clear negative signals.

As long as intraday trading remains below the 39100 resistance level, the downward trend is likely to continue. A break below the 38680 support could pave the way for further losses, potentially reaching 38510.

However, a decisive move above 39100, with at least an hourly candle close above this level, could invalidate the bearish scenario and trigger a retest of 39380 before the market determines its next direction.

Important Note: Trading in the current market environment carries a high level of risk. The potential for significant price fluctuations due to ongoing geopolitical tensions is elevated, and caution is advised.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations