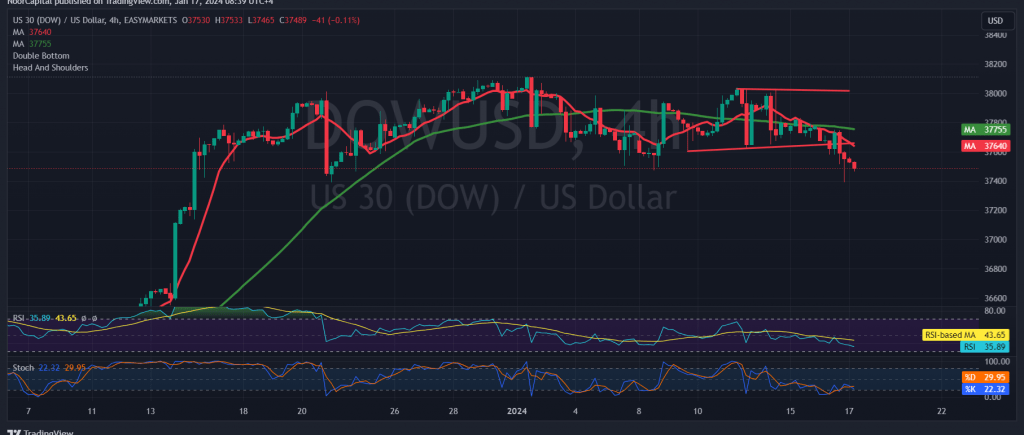

The Dow Jones Industrial Average experienced significant losses on the Wall Street Stock Exchange, surpassing the bearish targets set and reaching the official target of 37,555, marking its lowest point at 37,390.

Upon closer examination of the 4-hour chart, the simple moving averages continue to exert negative pressure on the price from below. This aligns with the Stochastic indicator positioning around the oversold areas.

Given the current state of daily trading below the resistance level of 37,690, the bearish scenario appears to be the most likely during the day. The initial target is set at 37,330, and breaking this level would intensify and accelerate the strength of the daily bearish trend, with the next station waiting at 37,180.

It’s crucial to note that price consolidation above 37,695 could thwart the temporary decline scenario, leading the index to reclaim the official upward trajectory. Targets in this case start at 37,900 and extend to 38,050.

Warning: Today, we are anticipating significant economic data from the American economy, including “retail sales” from the United Kingdom and “annual consumer prices.” Expect heightened price fluctuation during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations