As expected, the Dow Jones Industrial Average jumped on Wall Street yesterday as part of the positive outlook, surpassing the required targets at 34,850 to record its highest level at 34,946.

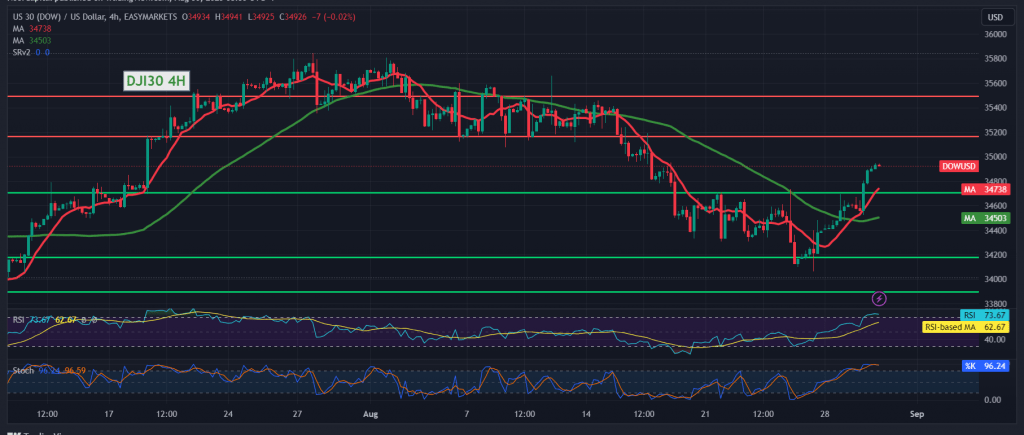

Technically, by looking closely at the 4-hour chart, we find the stochastic indicator centred around the overbought areas, accompanied by the continuation of the index obtaining a positive impulse from the simple moving averages, in addition to the stability of trading above the breached resistance level 34710.

This encourages us to maintain our positive expectations, knowing that confirmation of the penetration of 34,960 catalysts enhances the chances of touching 35,075 initial stations, whose goals may extend later to visit 35,220.

A decline below 34,700, and more importantly, 34,660, can delay the suggested scenario and put the index under negative pressure to retest 34,380 initially.

Note: the risk level may be high.

Note: Today, we are awaiting high-impact economic data issued by the US economy “ADP Employment Change” and “the preliminary reading of the GDP” quarterly, and we may witness a high fluctuation in prices at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations