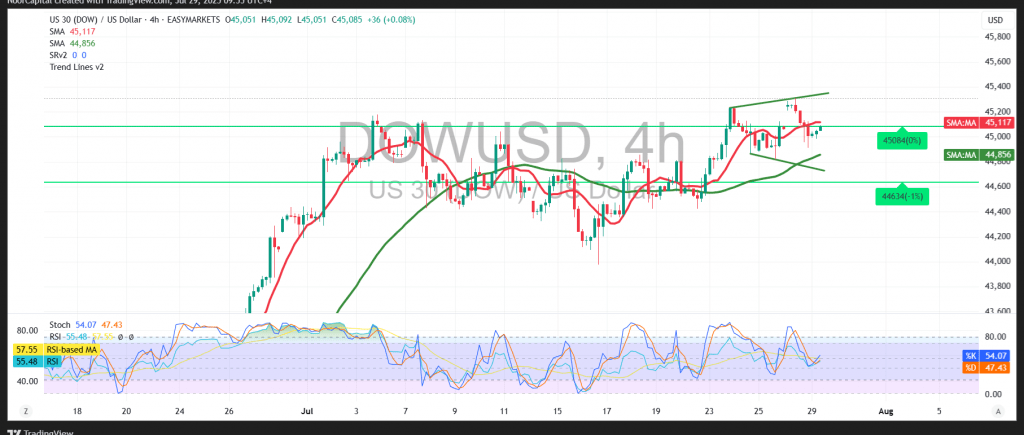

The Dow Jones Industrial Average extended its strong upward momentum on Wall Street, validating the bullish outlook highlighted in our previous report. The index not only surpassed the projected target of 45,150 but also recorded a new high at 45,311.

Technical Outlook for Today:

From a technical perspective, the index continues to benefit from sustained positive momentum, supported by stability above the key Simple Moving Averages (SMAs), which act as dynamic support zones. Additionally, the Relative Strength Index (RSI) is issuing bullish signals, reinforcing the potential for continued upward movement.

Likely Scenario:

As long as the index remains above the key support levels at 44,910 and, more critically, 44,895, the prevailing uptrend is expected to continue. A confirmed break above the 45,210 resistance level could serve as a bullish catalyst, potentially paving the way for an advance toward the next resistance at 45,295.

Alternative Scenario:

A sustained move below the 44,895 support level could shift momentum to the downside, placing the index under bearish pressure with an initial target of 44,710.

Warning: Risk levels remain elevated amid persistent trade and geopolitical tensions. Traders should remain alert to increased volatility and be prepared for multiple market outcomes.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations