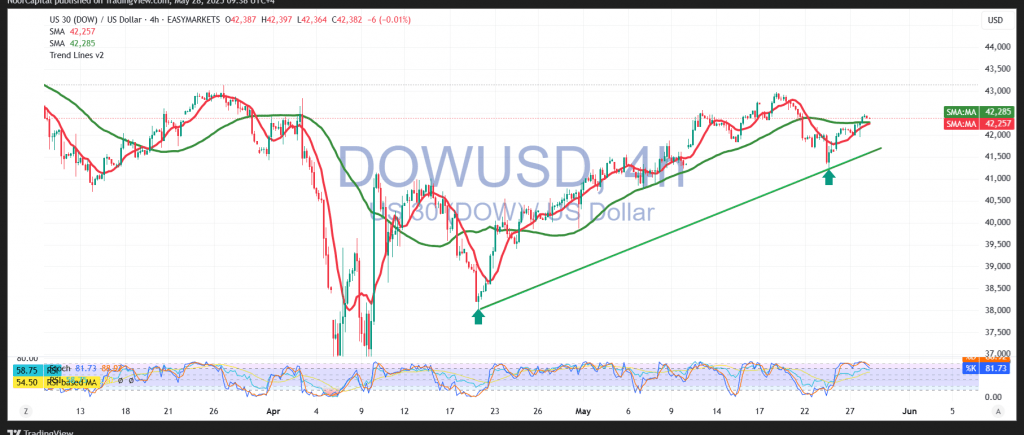

The Dow Jones Industrial Average (DJIA) posted solid gains during the previous Wall Street session, breaking above and consolidating above the 42,170 resistance level, confirming a bullish breakout.

From a technical perspective, the Relative Strength Index (RSI) continues to reinforce the upward momentum, while the simple moving averages provide additional support, acting as dynamic levels of demand.

As long as price action holds above 42,250, the bias remains firmly bullish. The next immediate target lies at 42,590, with a potential extension toward 42,800 should momentum continue to build.

However, a break below 42,250 may temporarily interrupt the bullish bias, but it does not fully negate the upward potential. In such a scenario, the index could see a retracement toward 42,060 before resuming its uptrend.

Key Event Risk Today:

Traders should prepare for heightened volatility surrounding the release of the Federal Reserve meeting minutes later today. This key event could significantly impact U.S. equity markets, including the DJIA.

Risk Disclaimer:

With ongoing trade tensions and macroeconomic uncertainty, risk levels remain high. Traders should remain vigilant and prepared for potential sharp market reactions.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations