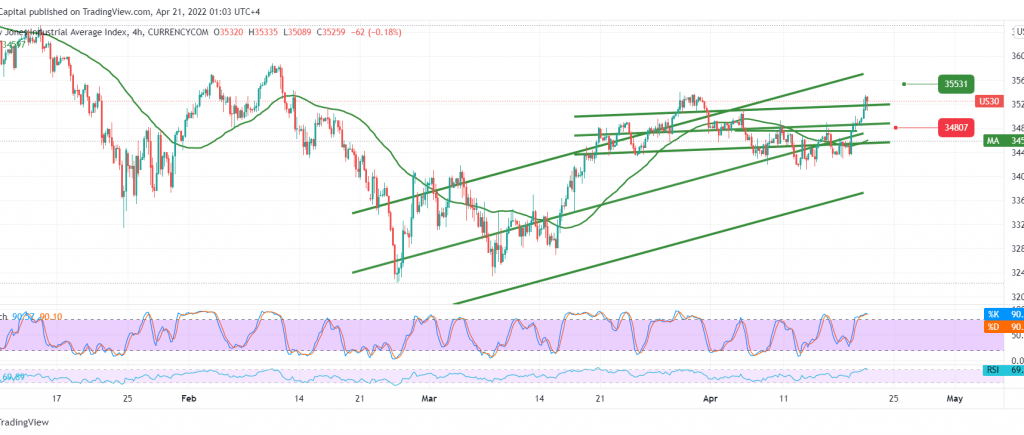

The Dow Jones Industrial Average extended its gains as expected, touching the first official target that is required to be achieved around 35,040, approaching the second target of 35,290, only to record the highest 35,231.

Technically, today, we are inclined to the positivity, relying on a base above 34,840 and, most importantly 34,800, accompanied by the stochastic indicator’s positioning around the overbought areas and the positive signals on RSI.

Therefore, the bullish scenario is the most preferred, knowing that confirming the breach of 35,230 extends the index’s gains. The door is directly open to visit 35,345 first target, and then 35,540 as long as possible the index is stable at 34,800.

Declining below 34,800 puts the index under temporary negative pressure that aims to retest 34,530.

Note: The risk level is high, and we may see volatile movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations