The Dow Jones Industrial Average continues to register gains on Wall Street, reaching its highest level of 38,303 during the first trading session of the week.

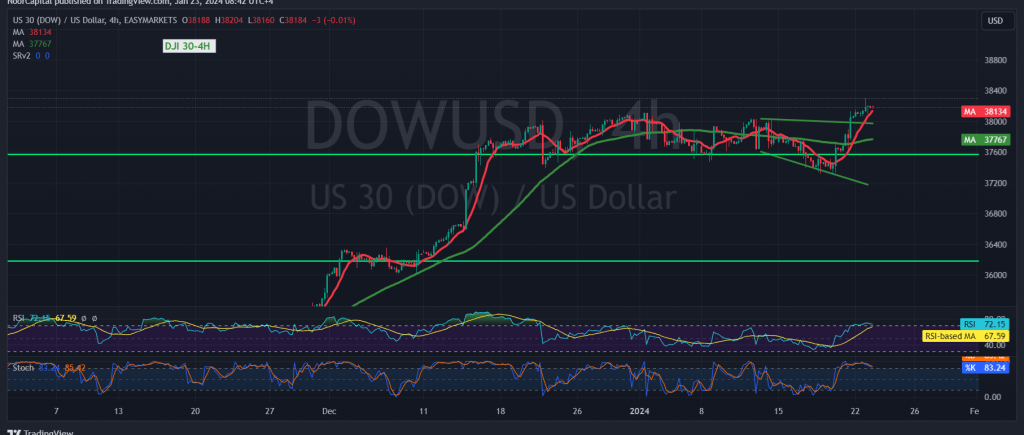

From a technical perspective, a positive outlook is favored, supported by the indicator receiving positive momentum from the simple moving averages that are consistently lifting the price from below. Additionally, clear positive signals are observed on the relative strength index, with its stability above the 50 midline.

With trading remaining stable above the previously breached resistance, now acting as a support level, the upward trend remains valid. A breach of 38,300 would intensify and accelerate the strength of the upward trend, opening the path towards 38,420 and 38,540, respectively.

However, a return to trading stability below 38,065 could disrupt the proposed bullish scenario, putting the index under significant negative pressure with an initial target of 37,950.

Traders are advised to exercise caution as the risk level is deemed high, especially considering ongoing geopolitical tensions that may contribute to increased price volatility. Monitoring market developments and price movements is crucial for informed decision-making.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations