The Dow Jones Industrial Average achieved strong gains on Wall Street yesterday, touching the official target to be achieved at 32,705, recording its highest level at 32,923.

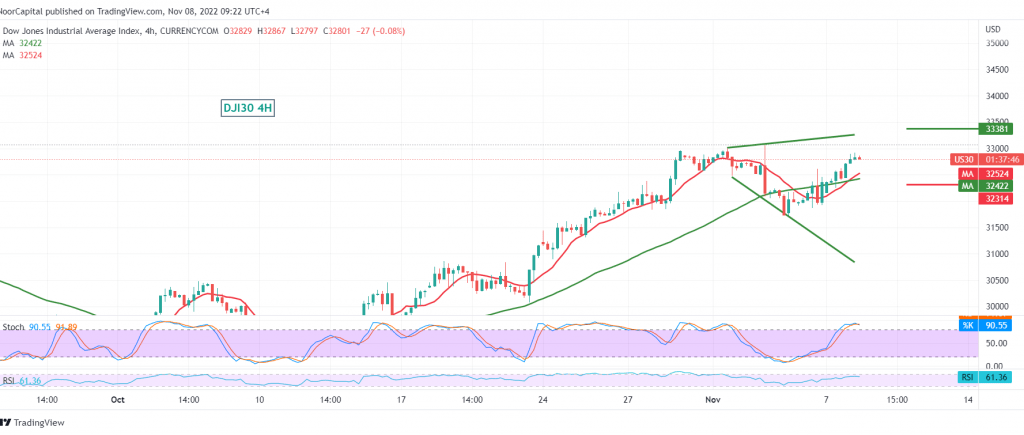

Technically, and by looking at the chart with a 60-minute interval, the simple moving averages continue to support the ascending curve of prices, and the RSI continues to defend the daily bullish trend.

From here and steadily, daily trading is above 32,420. In general, above 32,340, the bullish scenario may remain the most likely, provided that we witness a clear and strong breach of the 32,920 resistance level, and that is a catalyst that enhances the chances of touching 33,100 first target. The targets may extend later to visit 33,390.

The decline below 32,340 will immediately stop the suggested bullish scenario and lead the index to enter a bearish slope, to retest 31,890.

Note: the US Congress “House of Representatives” elections are due today and have a high impact and we may witness clear fluctuations in prices when the results are released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations