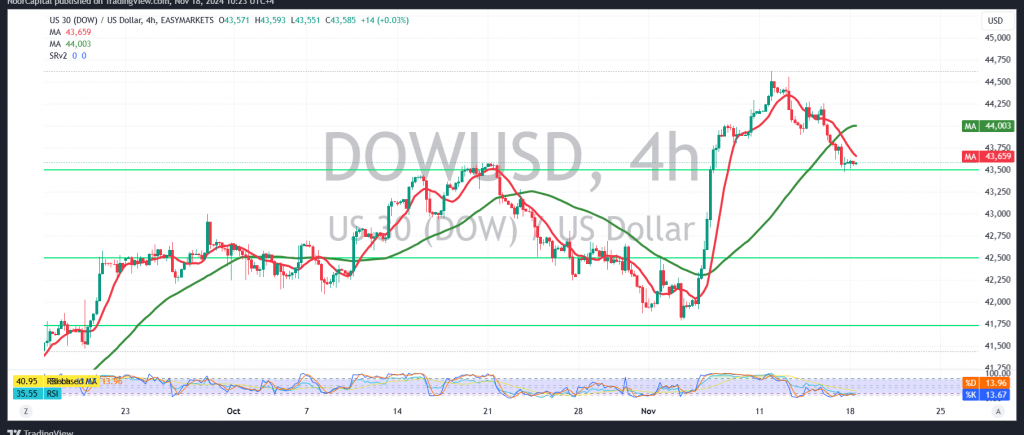

The Dow Jones Industrial Average experienced a sharp decline on the New York Stock Exchange at the end of the week, aligning with the expected downward trend and reaching the initial target of 43,695, with a recorded low of 43,478.

Technically, the outlook remains cautiously bearish, supported by the pair’s trading stability below the simple moving averages, which continue to exert downward pressure. Additionally, trading remains below the key resistance levels of 43,600 and 43,680.

Therefore, a continuation of the downward trend is likely in the coming hours, with 43,440 as the next target. Breaking below this level may lead to further losses, potentially driving the index down to 43,295.

However, a shift above 43,680 could disrupt the bearish scenario, suggesting a recovery and enabling the index to target 43,770, followed by 43,955 in the short term.

Warning: The risk level is high and may not match the expected returns, so careful consideration is necessary.

Warning: Given ongoing geopolitical tensions, high market volatility is possible, and multiple scenarios should be anticipated.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations