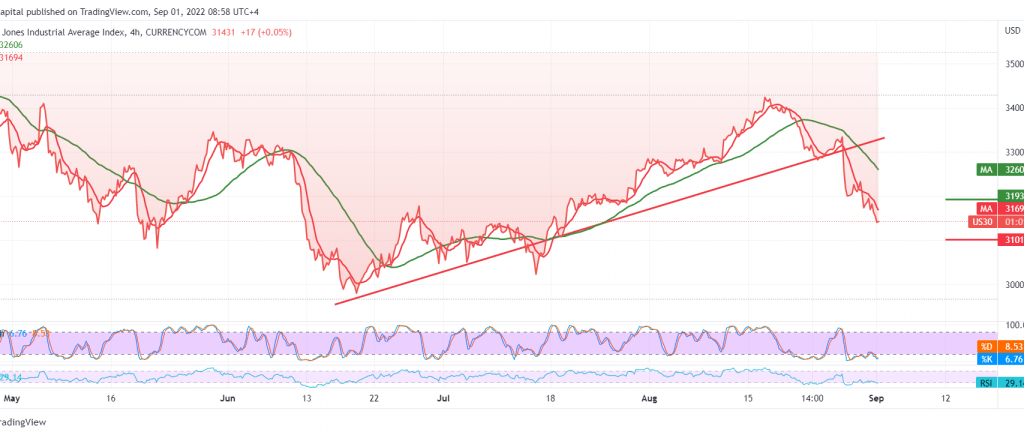

Significant losses within a solid bearish trend dominated the movements of the Dow Jones Industrial Average on Wall Street, within the expected negative outlook during the previous technical report, exceeding the required bearish targets at 31600, recording its lowest level at 31360.

Technically, we find that the 14-day momentum indicator continues to defend the bearish trend, in addition to the stochastic’s positioning around the overbought areas, and therefore with the stability of trading and the price’s pivot below 31,600, and most importantly 31,700. Breaking the mentioned level increases and accelerates the continuation of the descending wave, so we will be waiting to touch 31,195 initially.

From above, consolidation above 31,700 will postpone the suggested scenario and lead the index to temporary recovery attempts to visit 31,845.

Note: the risks are high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations