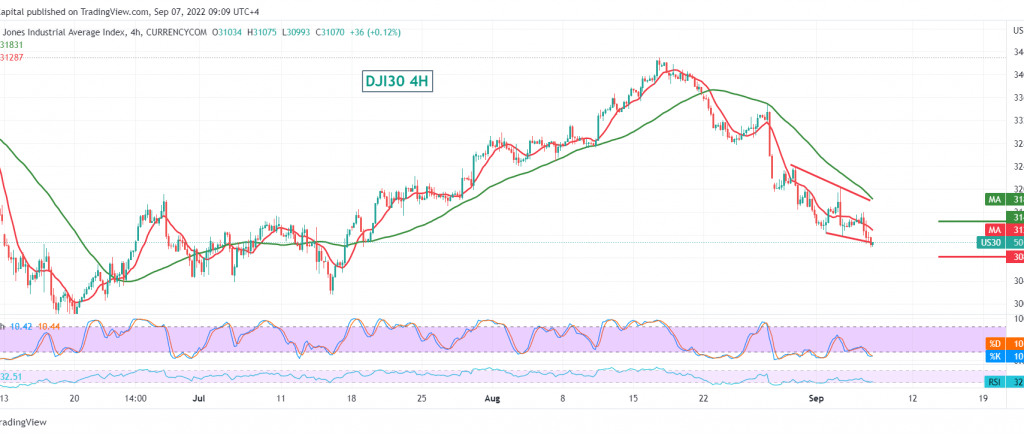

The Dow Jones Industrial Average on Wall Street achieved the idea of a temporary rise published during the previous analysis, touching the first required target of 31,540, recording its highest level of 31,590, to decline strongly again. As a reminder, we indicated that breaking the pivotal support floor of 31,300 opens the door to visit 31,200 and 31070, respectively, recording Its low at 30,970.

Technically, we tend to the negativity, relying on the RSI’s continued defence of the bearish trend and the negative pressure coming from the simple moving averages.

Hence, steadily trading below 31,250, and most importantly 31,280, the daily bearish trend remains valid, knowing that breaking 31,000 facilitates the task required to visit 30,900 and 30,820 primary targets whose wave of losses may extend later towards 30,600.

From above, consolidation above 31,280 leads the index to recover to retest 31,440.

Note: the risks are high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations