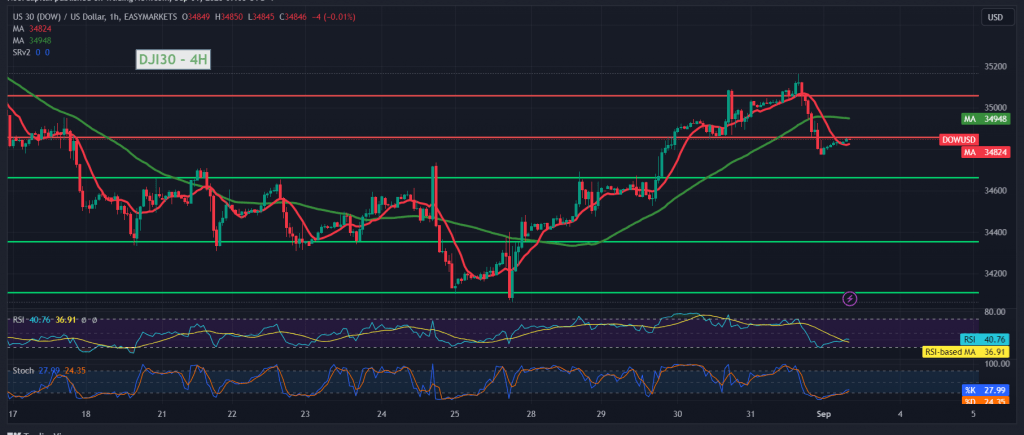

Mixed trading dominated the movements of the Dow Jones Industrial Average, only recording the first target, at 35130, recording its highest level of 35,165, then it returned to trading negatively, recording its lowest level of 34,770.

Technically, in our trading, we are leaning toward intraday negativity, but with caution, relying on the clear negative signals on the Stochastic indicator and the negative signals coming from the 14-day momentum indicator and its stability below the 50 midline.

From here, with trading remaining below 35,000, we may witness a decline in the coming hours, targeting 34,690 as the first target, and breaking it may extend the index’s losses, as we wait for 34,530.

Only a return to trading stability above 35,000 can postpone the proposed scenario and lead the index to recover with a target of 35,085 and 35,320, initial targets that may extend towards 35,400.

Note: Risk level may be high.

Note: Today we are awaiting high-impact economic data issued by the American economy (US jobs data NFP, average wages, unemployment rate and manufacturing PMI), and from the Canadian economy, we are awaiting “Gross Domestic Product” and we may witness high volatility at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations